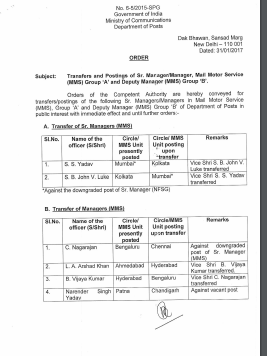

Consolidated Transfer policy to the regular transfers of officers/officials of the DOP

Consolidated Transfer policy to the regular transfers of officers/officials of the Department of Posts other than the Officers of Indian Postal Service, Group A

...

Read More ->>

→

→