Budget 2017: FM Arun Jaitley provides insights on income tax collection in India

Tax compliance leaves a lot to be desired, says finance minister Arun Jaitley days before the presentation of Budget 2017.

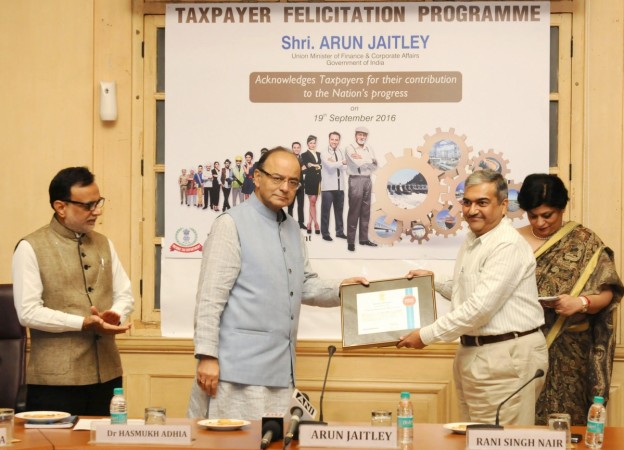

Finance Minister Arun Jaitley reiterated many aspects of tax compliance in his recent Facebook post that give insights into the lesser number of taxpayers in India. The post needs to be seen in the context of a comment by him that tax rates need to be "globally competitive" in India, a hint seen by some analysts as an indication of relief to individual income tax payers, if not corporates.

He is scheduled to present Budget 2017 on February 1 amid opposition parties objecting to it, saying it has the potential to give unfair advantage to the BJP in the upcoming state assembly elections. The BJP is keen to wrest control from the ruling Samajwadi Party in Uttar Pradesh, the most populous state of India.

The budget will also come in the backdrop of the Modi government lowering the GDP growth rate forecast to 7.1 percent for the current fiscal from the 7-7.75 percent projected earlier and 7.6 percent growth rate registered in 2015-16.

Here are some of the key aspects highlighted by the finance minister in his post

- In the year 2015-16, 3.7 crore assesses of the total population of over 125 crores, filed income tax returns.

- Out of these, 99 lakhs declared income below Rs.2.5 lakhs and paid no taxes; 1.95 crores declared income less than Rs.5 lakhs; 52 lakhs declared income between Rs.5 to10 lakhs, and only 24 lakhs declared income above Rs.10 lakhs.

- No better evidence is required to substantiate that both in the matter of direct and indirect taxes India continues to suffer being a hugely tax non-compliant society.

- When 86% of a country's currency constituting 12.2% of its GDP, is squeezed out of the market and sought to be replaced by a new currency, there would obviously be significant consequences.

It may be recalled here that the government initiated a nationwide crackdown on tax evaders and black money hoarders after announcing the decision to demonetise Rs 500 and Rs 1,000 currency notes (constituting 86 percent of the notes in circulation).

Between November 8, 2016 and January 5, 2017, defaulters have admitted to undisclosed income worth Rs 4,807 crore, while Rs 609.39 crore has been seized in cash and jewellery, according to an IANS report. New currency notes worth Rs 112 crore were part of the seizure and 5,184 notices have been issued to various entities, the report added, citing income tax sources.

In a related development on Monday, the finance ministry said direct taxes comprising corporate and personal tax rose 12.01 percent for the April-December 2016 period in comparison to the corresponding nine months in the previous fiscal while indirect taxes grew 25 percent.

→

→

0 comments:

Post a Comment