By Sachin Dave, ET Bureau

The income-tax department has begun raising queries with regard to what it thinks are suspicious bank deposits, including those made in cooperative banks, said tax officials and consultants with direct knowledge of the matter.

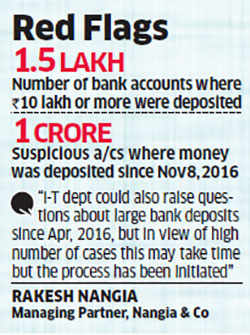

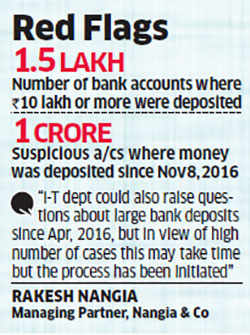

The move is part of the government’s crackdown on money laundering in the wake of demonetisation. “In the first round, the tax department is focusing on those bank accounts that do not have proper KYC (know your customer) credentials or cash deposits do not correspond with the individual’s income,” said one of them. ETreported on January 19 that the I-T department was looking to question cash deposits exceeding Rs 10 lakh.

About 1.5 lakh accountholders have deposited more than Rs 10 lakh each and there have been suspicious cash deposits in one crore accounts belonging to 75 lakh people, ET said.

The tax department is specifically targeting some people in the first round based on big data analytical tools deployed by the Central Board of Direct Taxes (CBDT). This is being used to examine bank deposits to segregate black money holders from genuine tax payers. It compares tax returns of individuals, tax paid by companies owned by some people and other tax-related data with information collected from banks on how much money was deposited by individuals.

The tax department is specifically targeting some people in the first round based on big data analytical tools deployed by the Central Board of Direct Taxes (CBDT). This is being used to examine bank deposits to segregate black money holders from genuine tax payers. It compares tax returns of individuals, tax paid by companies owned by some people and other tax-related data with information collected from banks on how much money was deposited by individuals.

The queries are raised through an online platform seeking explanations from those who have deposited large sums since demonetisation was announced on November 8. Only those with permanent account numbers (PAN) or Aadhaar identities can access the e-platform.

The queries raised are very specific and in some cases tax officials are demanding that bank account holders submit scanned copies of their PAN and Aadhaar cards. Experts said bank account holders who have not cleared the KYC process, especially in some cooperative banks, are to be questioned first.

In the first round, the tax department will concentrate on suspicious accounts in which at least Rs 10 lakh was deposited after demonetisation was announced.

“As we see, the tax department could also raise questions about large bank deposits since April 2016, but in view of a high number of cases, this may take some time but the process has been initiated. However, care should be taken that black money hoarders must be targeted and genuine tax payers are not harassed,” said Rakesh Nangia, managing partner, Nangia and Co., a tax advisory.

“This is the first phase where queries are raised by tax department and we suspect that all bank accounts will not attract questions. The tax office may pick up accounts which may look suspicious, considering information collected from other sources,” said Amit Maheshwari, partner, Ashok Maheshwary and Associates.

“In some cases where such depositor is not having PAN, he needs to obtain PAN first and then only he would be able to log in to the system for responding. All those who have received queries are required to respond on the e-platform,” said Paras Savla, partner, KPB & Associates, a tax consultancy. “The analytical tools raise red flags wherever there are discrepancies,” said a person in the know.

The move is part of the government’s crackdown on money laundering in the wake of demonetisation. “In the first round, the tax department is focusing on those bank accounts that do not have proper KYC (know your customer) credentials or cash deposits do not correspond with the individual’s income,” said one of them. ETreported on January 19 that the I-T department was looking to question cash deposits exceeding Rs 10 lakh.

About 1.5 lakh accountholders have deposited more than Rs 10 lakh each and there have been suspicious cash deposits in one crore accounts belonging to 75 lakh people, ET said.

The tax department is specifically targeting some people in the first round based on big data analytical tools deployed by the Central Board of Direct Taxes (CBDT). This is being used to examine bank deposits to segregate black money holders from genuine tax payers. It compares tax returns of individuals, tax paid by companies owned by some people and other tax-related data with information collected from banks on how much money was deposited by individuals.

The tax department is specifically targeting some people in the first round based on big data analytical tools deployed by the Central Board of Direct Taxes (CBDT). This is being used to examine bank deposits to segregate black money holders from genuine tax payers. It compares tax returns of individuals, tax paid by companies owned by some people and other tax-related data with information collected from banks on how much money was deposited by individuals. The queries are raised through an online platform seeking explanations from those who have deposited large sums since demonetisation was announced on November 8. Only those with permanent account numbers (PAN) or Aadhaar identities can access the e-platform.

The queries raised are very specific and in some cases tax officials are demanding that bank account holders submit scanned copies of their PAN and Aadhaar cards. Experts said bank account holders who have not cleared the KYC process, especially in some cooperative banks, are to be questioned first.

In the first round, the tax department will concentrate on suspicious accounts in which at least Rs 10 lakh was deposited after demonetisation was announced.

“As we see, the tax department could also raise questions about large bank deposits since April 2016, but in view of a high number of cases, this may take some time but the process has been initiated. However, care should be taken that black money hoarders must be targeted and genuine tax payers are not harassed,” said Rakesh Nangia, managing partner, Nangia and Co., a tax advisory.

“This is the first phase where queries are raised by tax department and we suspect that all bank accounts will not attract questions. The tax office may pick up accounts which may look suspicious, considering information collected from other sources,” said Amit Maheshwari, partner, Ashok Maheshwary and Associates.

“In some cases where such depositor is not having PAN, he needs to obtain PAN first and then only he would be able to log in to the system for responding. All those who have received queries are required to respond on the e-platform,” said Paras Savla, partner, KPB & Associates, a tax consultancy. “The analytical tools raise red flags wherever there are discrepancies,” said a person in the know.

Source : The Economic Times

→

→

0 comments:

Post a Comment