How to file ITR-1 Online ? – Income Tax 2016-17 (A.Year 2017-18) – Easy Steps to file Income Tax Return online for Salaried Class Employees

The Calculation and TDS process of Income Tax liability of Salaried Employees for the year 2016-17 (Assessment Year 2017-18) would have been over by this time. Now it’s time for Employees to receive Form-16 from the Employer and file their income tax return.

This tutorial covers ITR-1 which is meant for declarring income from salary and income or loss from one house property owned by the employee.

Who should file Income Tax Return ? Whether online filing of ITR is compulsory ?

As per the prevailing instructions under Income Tax Act, persons who has gross income more than Rs. 2.5 lakh during the financial year 2016-17will have to file Income Tax return. In respect of Senior Citizens income limit for filing ITR is Rs. 3 lakhs

As far as online filing ITR is concerned, Income Tax Assessee whose Total Income (Taxable Income) exceeds Rs. 5 lakh during the financial year 2016-17, will have to file online IT return only.

What are the methods of filing online ITR?

As far as E-Filing of Income Tax Returns is concerned, there are two methods.

1. Easy E-filing by entering the data directly on the Income Tax E-filing website . This is the most user friendly method. As of now, ITR-1 and ITR-4S can be filed in this method

2. E-filing of ITR using excel utility – In this method, users will have to enter values off-line in the Excel File utility downloaded from Income Tax website and then upload the XML file generated by the utility to the ITR E-filing domain. This method is relatively a complex one. However, Tax Payers who will have to file ITR other than ITR-1 and ITR-4S will have to file returns in this method only.

Steps to file ITR-1 (As per method 1 above)

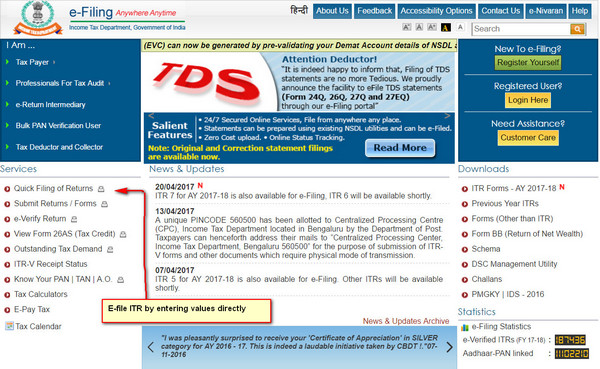

1. Go to this Income Tax Department’s Official online ITR filing Website. Register using your PAN and get user name and password, if you have not already registered.

2. After successful registration, Click the “Quick Filing of E-Returns” hyperlink available in the left menu

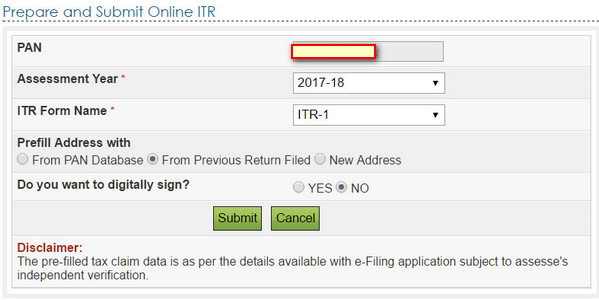

3. Once you have successfully logged in you will land in to following page

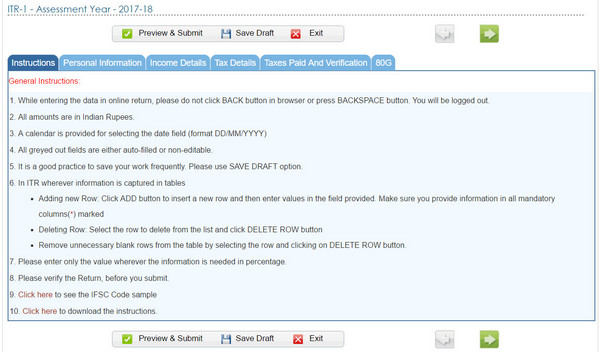

4. After you select the ITR type and relevant year for which ITR has to be filed, entry page of ITR will be shown. The first tab will be containing the instructions for filling the data

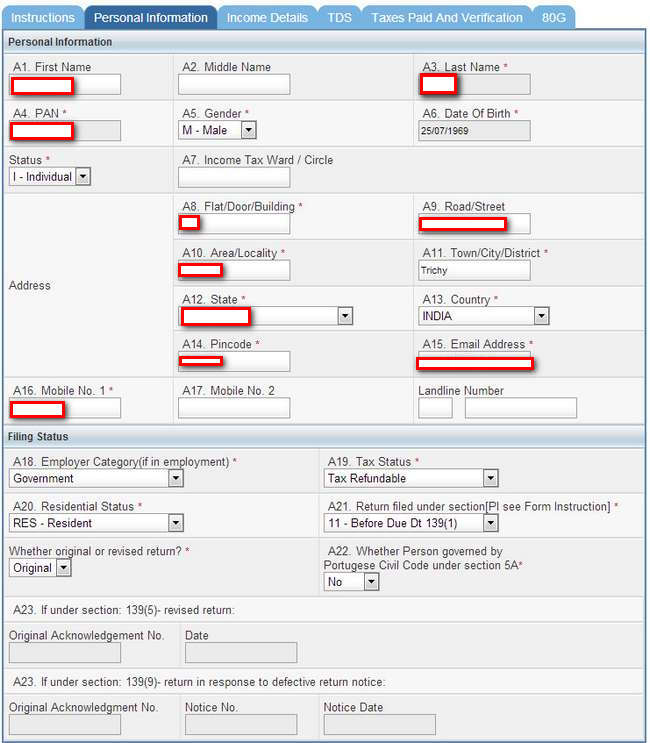

5. As you are in logged in session, it is better to save the data entered after each tab is completed. However, Submit Button has to be used only after entry of all the data. The following Screenshot is Personal Information entry tab. Once entry is completed save the data as draft and proceed to next tab.

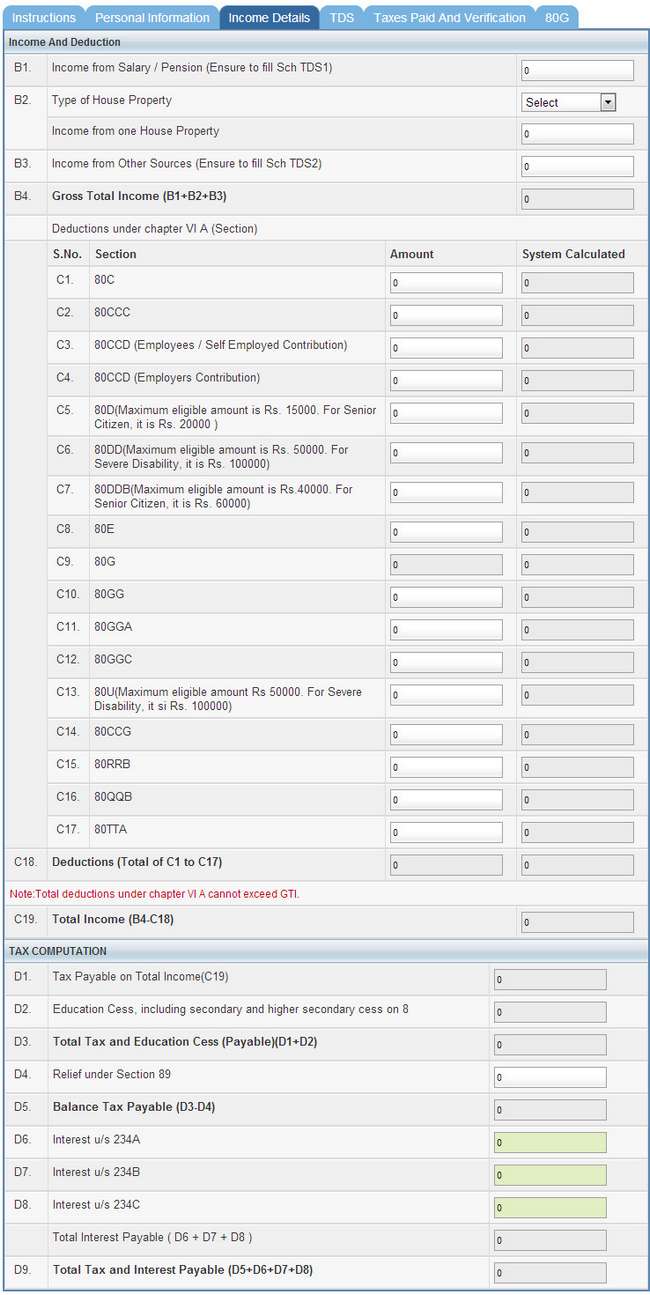

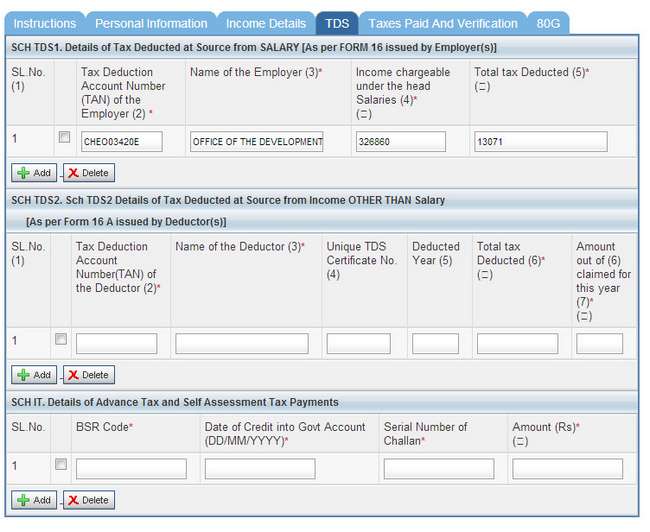

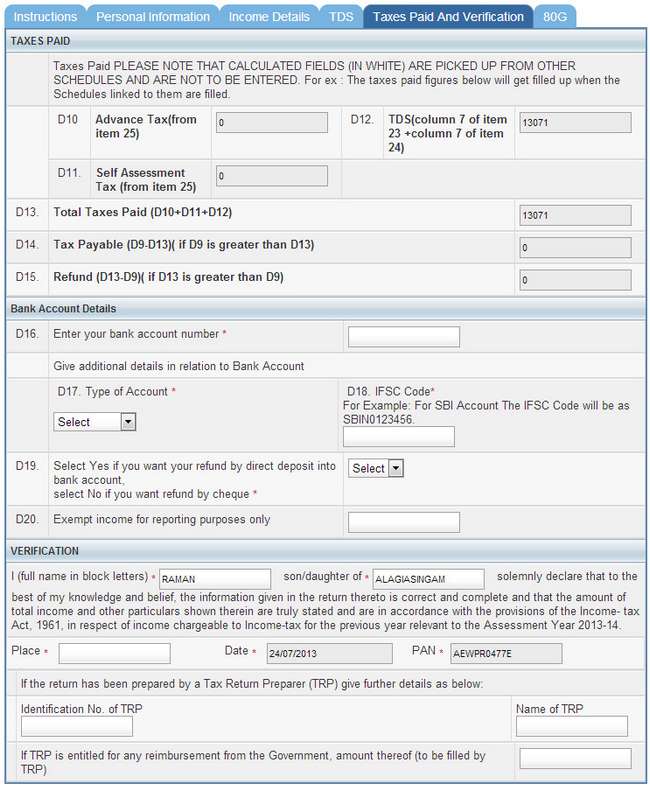

6. Following Screenshots are relating to entry tabs for Income Tax details, Details of Income Tax Deducted by employer, and Bank Account details. Enter the values in these fields as per Form-16 provided by the employer. Tax Deducted by the Employer and paid in to Govt Account will be available under TDS tab. TDS details can also be verified through Form-26AS which is an online feature available in Income Tax Website to get the details of the Income Tax Paid in respect of a PAN.

After entry of data in all these tabs are completed, click Submit button to generate ITR-V Button. ITR-V is a document which contains the summary of your income, deductions and income tax paid. This document has to be signed and sent to the Income Tax Central Processing Center at Bangalore. Address of this center will be available in the mail sent to you attaching filled up ITR-V form. Please note that Online E-filing will get completed only after receipt of this ITR-V at Central Processing Center at Bangalore.

Alternatively, the tax payer can also e-verify the return filed using his / her Aadhaar ID. In that case there is no need to send the physical copy of ITR-5 to Income Tax Central Processing Center

The following Video Tutorial has been provided by Income Tax Department for Online Income Tax Return filing

→

→

0 comments:

Post a Comment