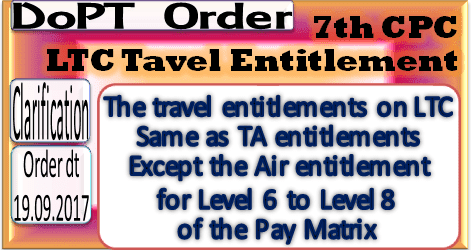

7th CPC Travel Entitlement on Leave Travel Concession w.e.f. 1st July, 2017: DoPT OM 19.09.2017

5. This O.M. will take effect from July 1, 2017.

6. Hindi version will follow.

Click for Finance Ministry OM

7th CPC TA Rules: Entitlement for Journeys on Tour or Training

Source: Click on the image below to view/download the PDF

No. 31011/8/2017-Estt.A-IV

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

Establishment A-IV Desk

North Block New Delhi.

Dated September19, 2017

OFFICE MEMORANDUM

Subject: Travel entitlements of Government employees for the purpose of LTC post Seventh Central Pay Commission-clarification reg.

The undersigned is directed to refer to this Department’s O.M. No. 31011/4/2008-Estt.A-IV dated 23.09.2008, which inter-alia provides that travel entitlements for the purpose of official tour/transfer or LTC, will be the same but no daily allowance shall be admissible for travel on LTC. Further, the facility shall be admissible only in respect of journeys performed in vehicles operated by the Government or any Corporation in the public sector run by the Central or State Government or a local body.

2. Consequent upon the decisions taken by Government on the recommendations of Seventh CPC relating to Travelling Allowance entitlements of Central Government employees, TA Rules have undergone changes vide Ministry of Finance’s O.M. No. 19030/1/2017-E.IV dated 13.07.2017.

3. In this regard, it is clarified that the travel entitlements of Government servants for the purpose of LTC shall be the same as TA entitlements as notified vide Ministry of Finance’s O.M. dated 13.07.2017, except the air travel entitlement for Level 6 to Level 8 of the Pay Matrix, which is allowed in respect of TA only and not for LTC.

4. Further, the following conditions may also be noted:

i. No daily allowance shall be admissible for travel on LTC.

ii. Any incidental expenses and the expenditure incurred on local journeys shall not be admissible.

iii. Reimbursement for the purpose of LTC shall be admissible in respect of journeys performed in vehicles operated by the Government or any Corporation in the public sector run by the Central or State Government or a local body.

iv. In case of journey between the places not connected by any public/Government means of transport, the Government servant shall be allowed reimbursement as per his entitlement for journey on transfer for a maximum limit of 100 Kms covered by the private/personal transport based on a self-certification from the Government servant. Beyond this, the expenditure shall be borne by the Government servant.

v. Travel by Premium trains/Premium Tatkal trains/Suvidha trains is now allowed on LTC. Further, reimbursement of tatkal charges or premium tatkal charges shall also be admissible for the purpose of LTC.

vi. Flexi fare (dynamic fare) applicable in Rajdhani/Shatabdi/Duronto trains shall be admissible for the journey(s) performed by these trains on LTC. This dynamic fare component shall not be admissible in cases where a non-entitled Government servant travels by air and claims reimbursement for the entitled class of Rajdhani/Shatabdi/Duronto trains.

5. This O.M. will take effect from July 1, 2017.

6. Hindi version will follow.

Sd/-

(Surya Narayan Jha)

Under Secretary to the Government of India

Under Secretary to the Government of India

Click for Finance Ministry OM

7th CPC TA Rules: Entitlement for Journeys on Tour or Training

Source: Click on the image below to view/download the PDF

→

→

0 comments:

Post a Comment