How To File Income Tax Return 2021-22 In The New Income Tax Portal?

Income Tax Return 2021-22 for Salaried Employees – How to to file your Return in the New Income Tax Portal – Step by Step guidance with screenshots

Facility for Filing of Income Tax Return (ITR-1 and ITR-2) to be filed by Salaried Employees has been made available now in the new income tax portal (incometax.gov.in)

We provide here a detailed write-up on applicable Income Tax Return to be filed by Salaried income taxpayers on the basis of factors such as number of house property, income other than salary etc.

1. ITR-1 (SAHAJ) – Applicable for Individual

This return is applicable for a Resident (other than Not Ordinarily Resident) Individual having Total Income from any of the following sources up to ₹ 50 lakh

| Salary / Pension | One House Property | Other sources (Interest, Family Pension, Dividend etc.) | Agricultural Income up to ₹ 5,000 |

Note: ITR-1 cannot be used by a person who:

(a) is a Director in a company

(b) has held any unlisted equity shares at any time during the previous year

(c) has any asset (including financial interest in any entity) located outside India

(d) has signing authority in any account located outside India

(e) has income from any source outside India

(f) is a person in whose case tax has been deducted u/s 194N

(g) is a person in whose case payment or deduction of tax has been deferred on ESOP

(h) who has any brought forward loss or loss to be carried forward under any head of income

2. ITR-2 – Applicable for Individual and HUF

This return is applicable for Individual and Hindu Undivided Family (HUF)

| Not having Income under the head Profits and Gains of Business or Profession | Who is not eligible for filing ITR-1 |

3. ITR-3- Applicable for Individual and HUF

This return is applicable for Individual and Hindu Undivided Family (HUF)

| Having Income under the head Profits and Gains of Business or Profession | Who is not eligible for filing ITR-1, 2 or 4 |

4. ITR-4 (SUGAM) – Applicable for Individual, HUF and Firm (other than LLP)

This return is applicable for an Individual or Hindu Undivided Family (HUF), who is Resident other than Not Ordinarily Resident or a Firm (other than LLP) which is a Resident having Total Income up to ₹ 50 lakh and having income from Business or Profession which is computed on a presumptive basis (u/s 44AD / 44ADA / 44AE) and income from any of the following sources:

| Salary / Pension | One House Property | Other sources (Interest, Family Pension, Dividend etc.) | Agricultural Income up to ₹ 5,000 |

Note: ITR-4 cannot be used by a person who:

(a) is a Director in a company

(b) has held any unlisted equity shares at any time during the previous year

(c) has any asset (including financial interest in any entity) located outside India

(d) has signing authority in any account located outside India

(e) has income from any source outside India

(f) is a person in whose case payment or deduction of tax has been deferred on ESOP

(g) who has any brought forward loss or loss to be carried forward under any head of income

Please note that ITR-4 (Sugam) is not mandatory. It is a simplified return form to be used by an Assessee, at his option, if he is eligible to declare Profits and Gains from Business or Profession on presumptive basis u/s 44AD, 44ADA or 44AE.

Step by Step guide to file ITR-1:

1. Overview

The pre-filling and filing of ITR-1 service is available to registered users on the e-Filing portal. This service enables individual taxpayers to file ITR-1 online through the e-Filing portal. This user manual covers filing of ITR-1 through online mode.

2. Prerequisites for availing this service

General |

|

Others |

|

3. Form at a Glance

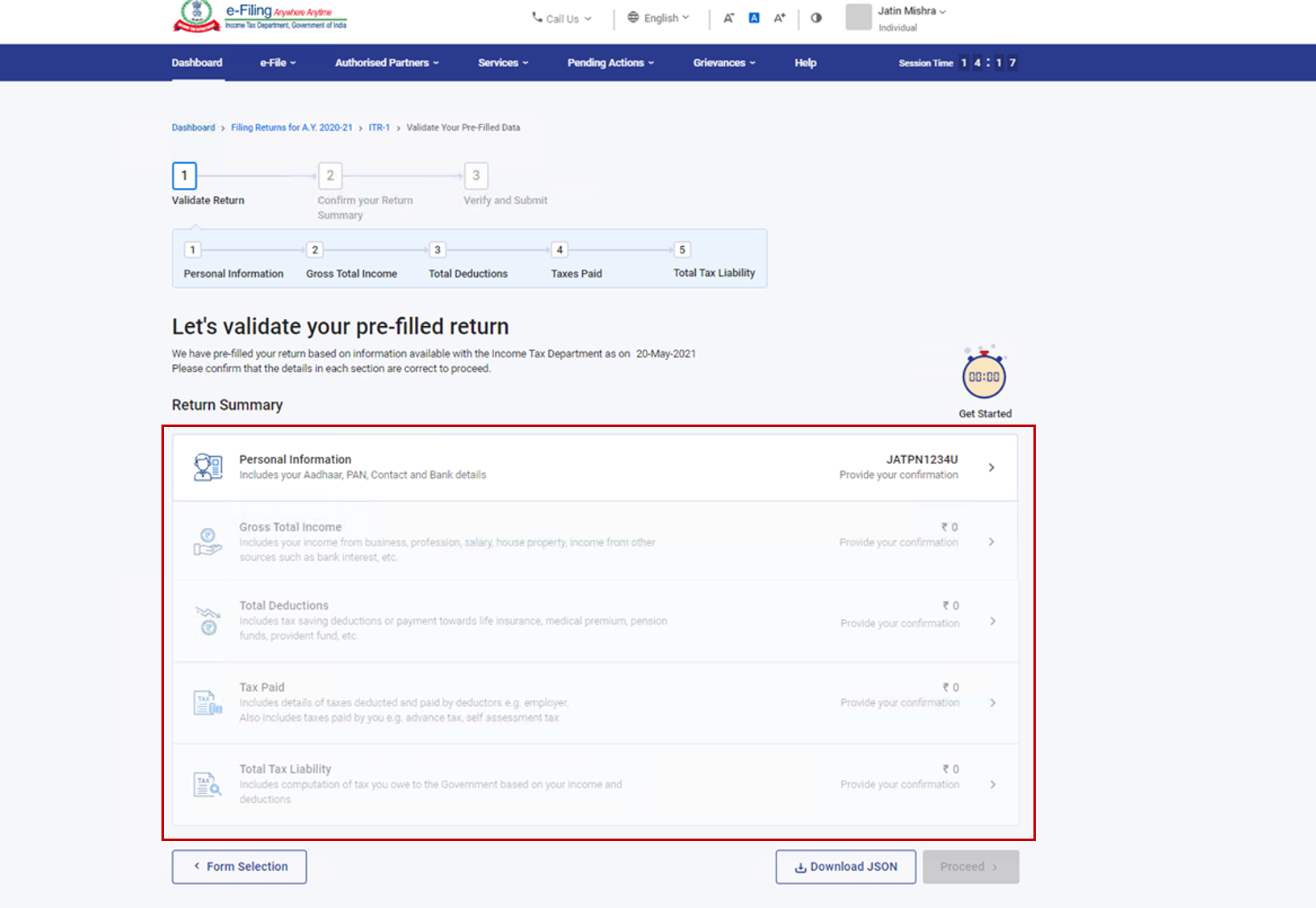

ITR-1 has five sections that you need to fill before submitting it and one summary section where you are required to review your tax computation. The sections are as follows:

- Personal Information

- Gross Total Income

- Total Deductions

- Tax Paid

- Total Tax Liability

Here is a quick tour of the various sections of ITR-1:

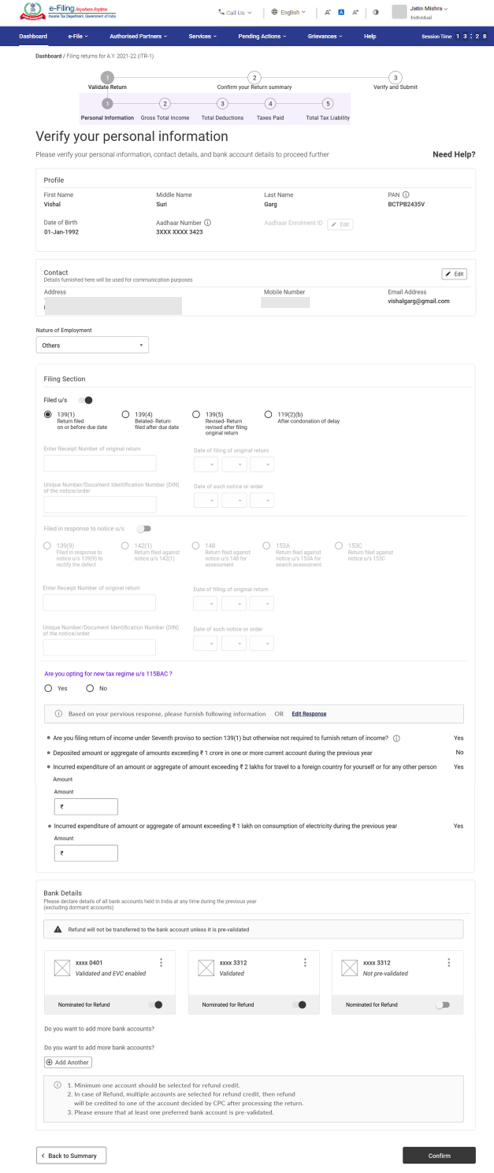

3.1 Personal Information

In the Personal Information section of the ITR, you need to verify the pre-filled data which is auto-filled from your e-Filing profile. You will not be able to edit some of your personal data directly in the form. However, you can make the necessary changes by going to your e-Filing profile. You can edit your contact details, filing type details and bank details in the form.

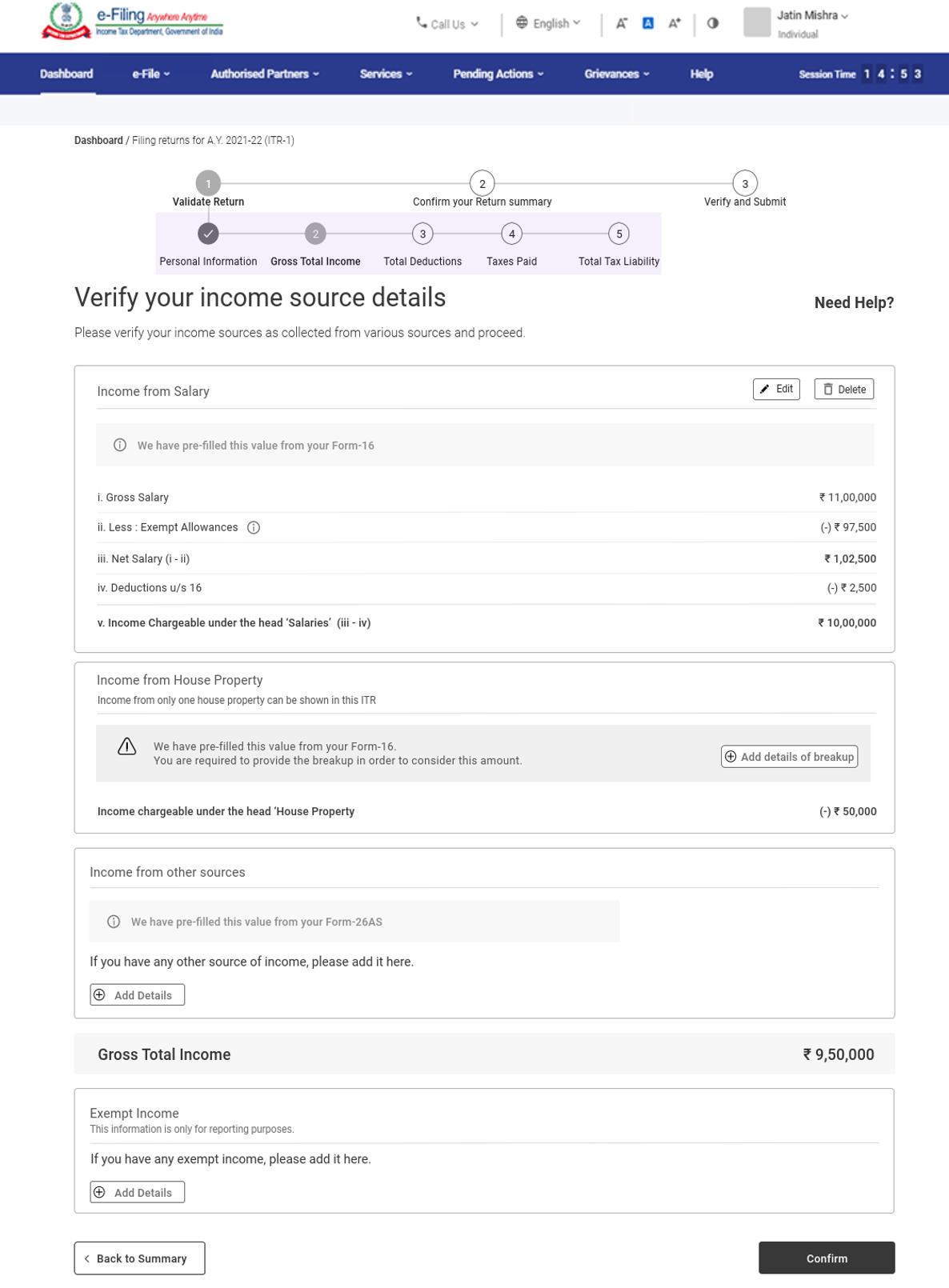

3.2 Gross Total Income

In the Gross Total Income section, you need to review the pre-filled information and verify your income source details from salary / pension, house property, and other sources (such as interest income, family pension, etc.).You will also be required to enter the remaining / additional details including your exempt income, if any.

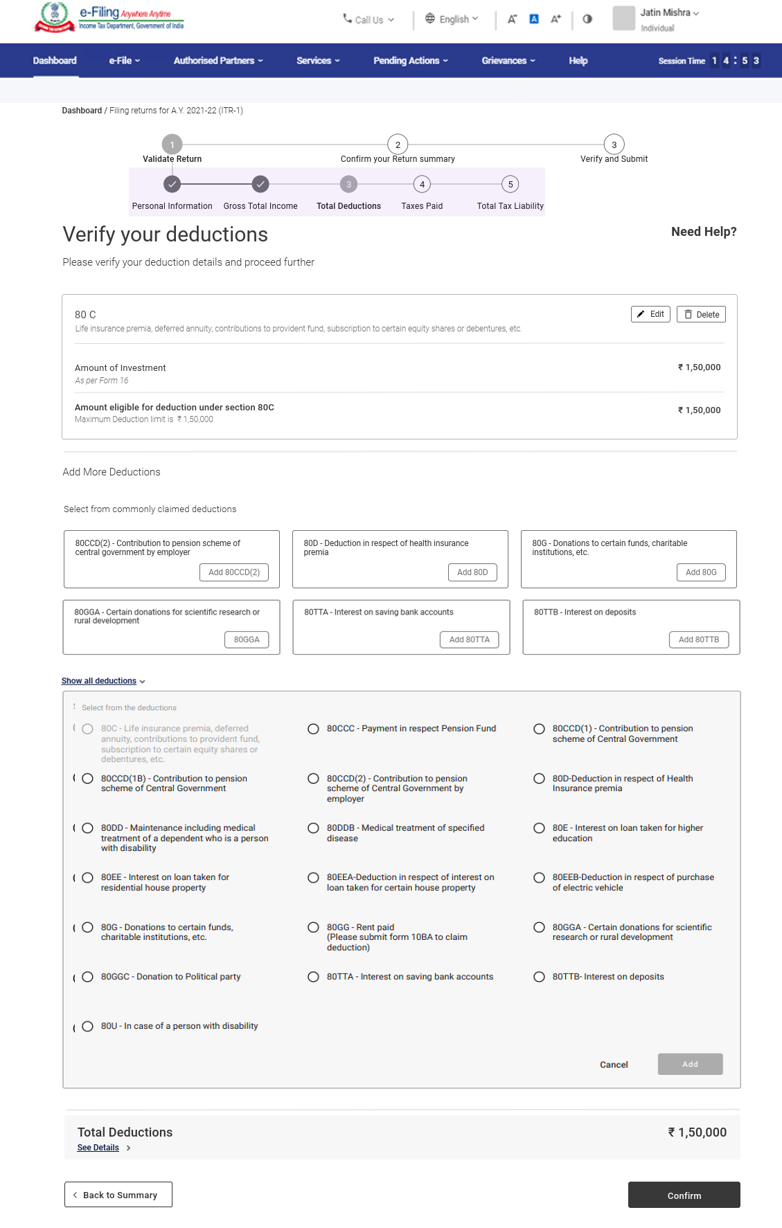

3.3 Total Deductions

In the Total Deductions section, you need to add and verify any deductions you wish to claim under Chapter VI-A of the Income Tax Act.

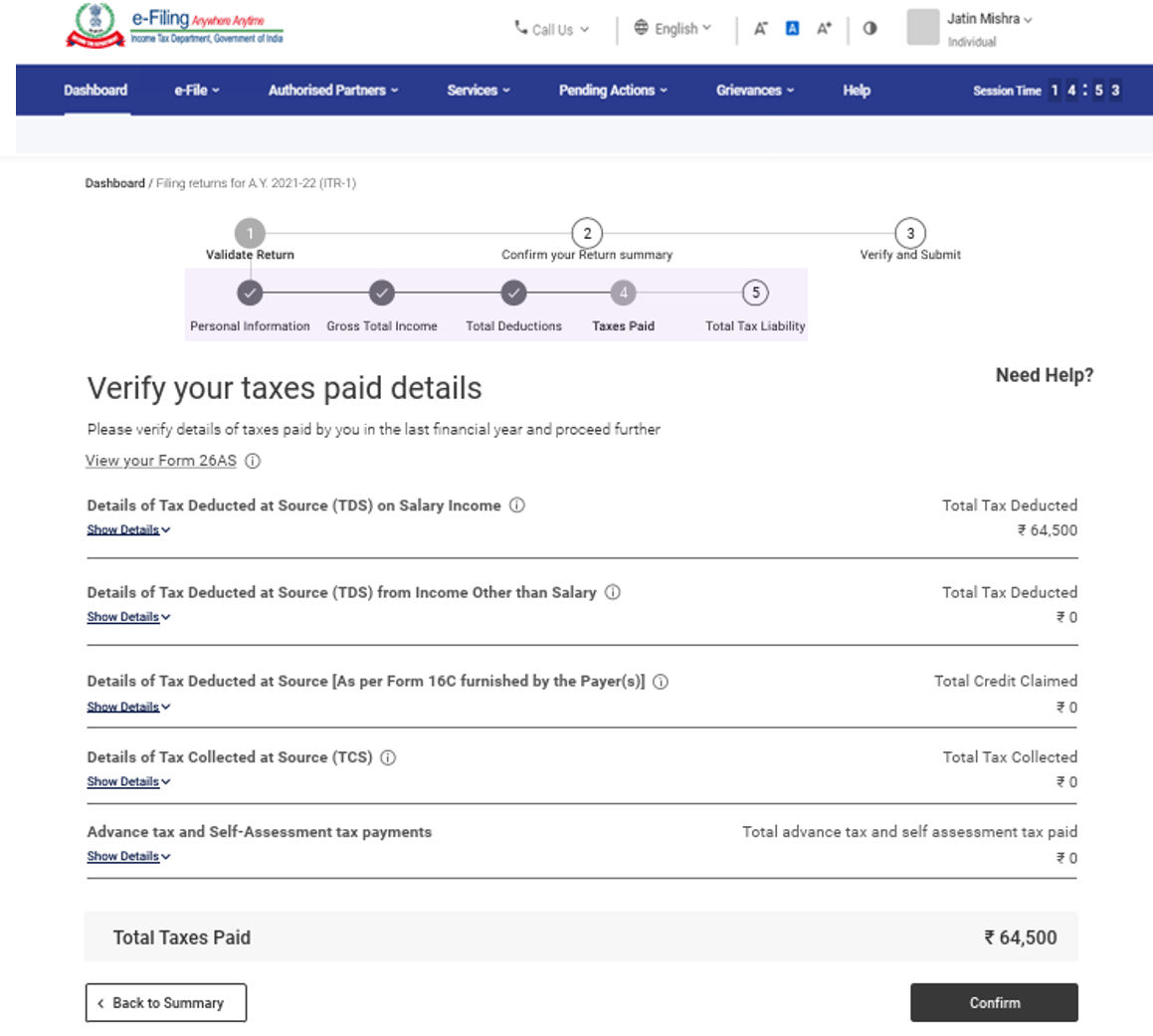

3.4 Tax Paid

In the Tax Paid section, you need to verify taxes paid by you in the previous year. Tax details include TDS from Salary / Other than Salary as furnished by Payer, TCS, Advance Tax and Self-Assessment Tax.

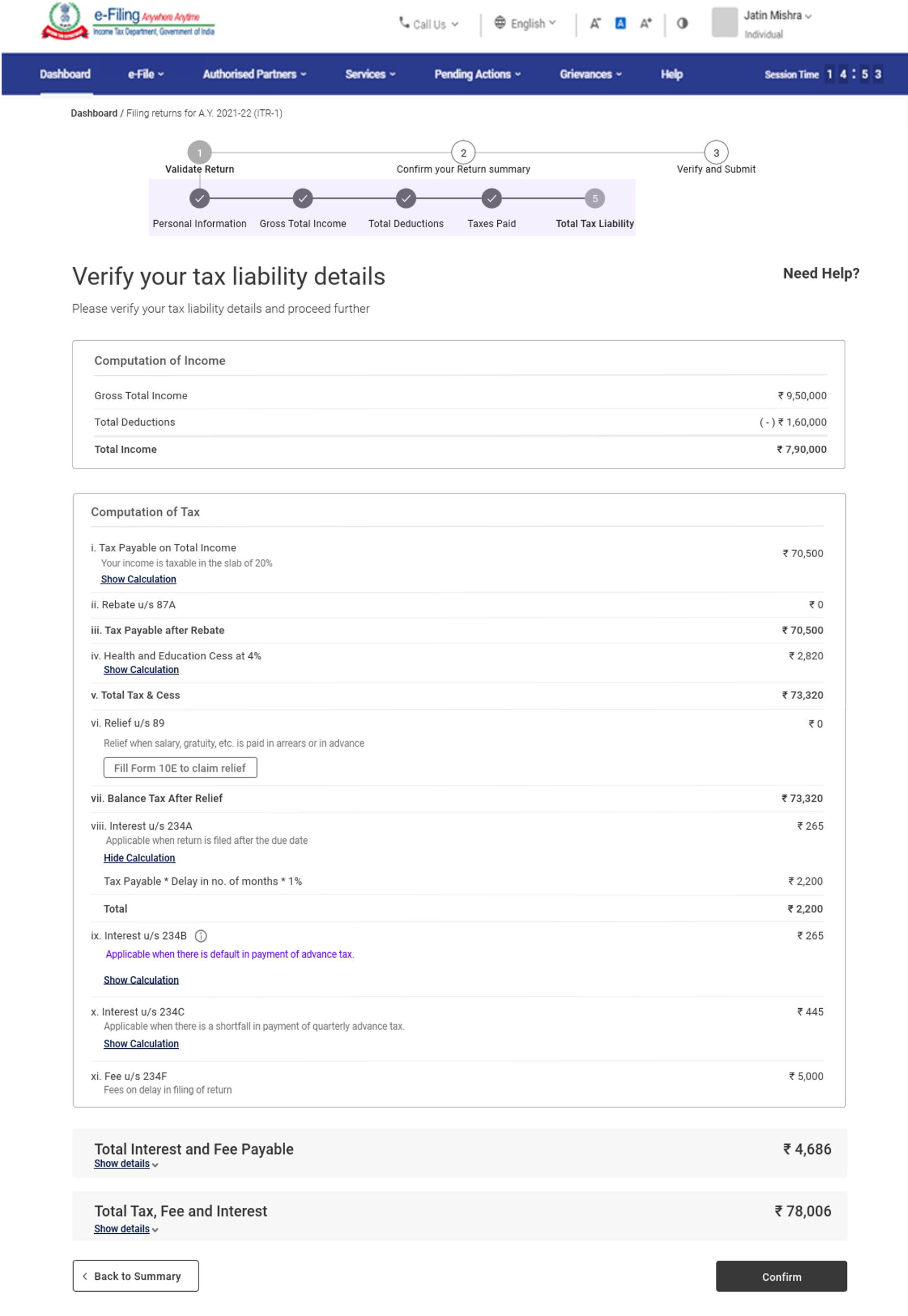

3.5 Total Tax Liability

In the Total Tax Liability section, you need to review tax liability computed as per the sections filled previously.

Note: For more details, refer to the instructions to file ITR issued by CBDT for AY 2021-22.

4. How to Access and Submit ITR – 1

You can file and submit your ITR through the following methods:

- Online Mode – through e-Filing portal

- Offline Mode – through Offline Utility

You can refer to the Offline Utility (for ITRs) user manual to learn more.

Follow the steps below to file and submit the ITR through online mode:

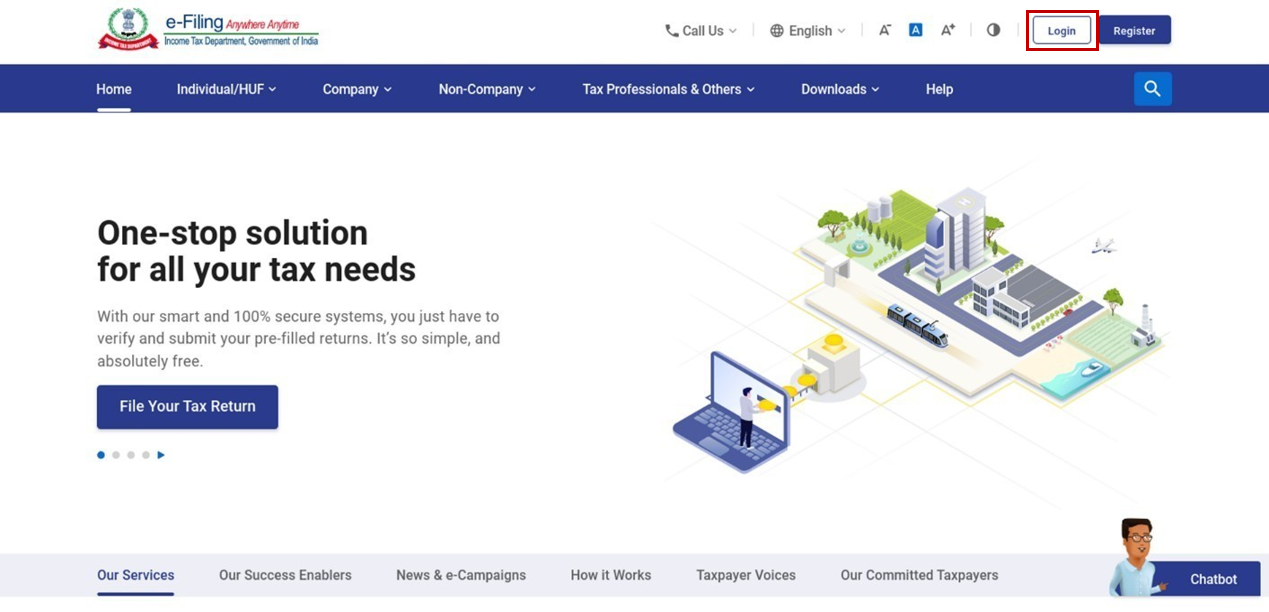

Step 1: Log in to the e-Filing portal using your user ID and password.

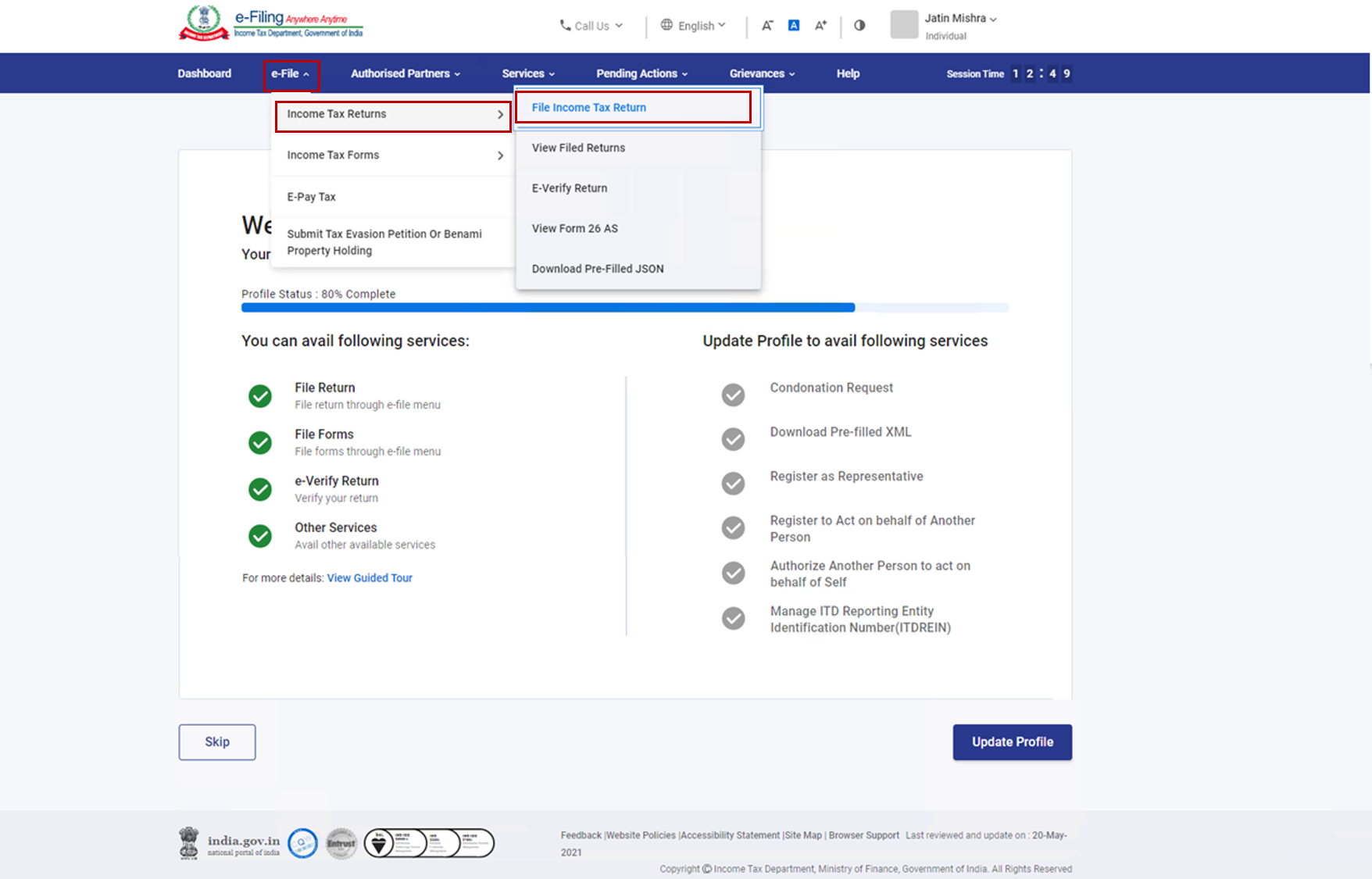

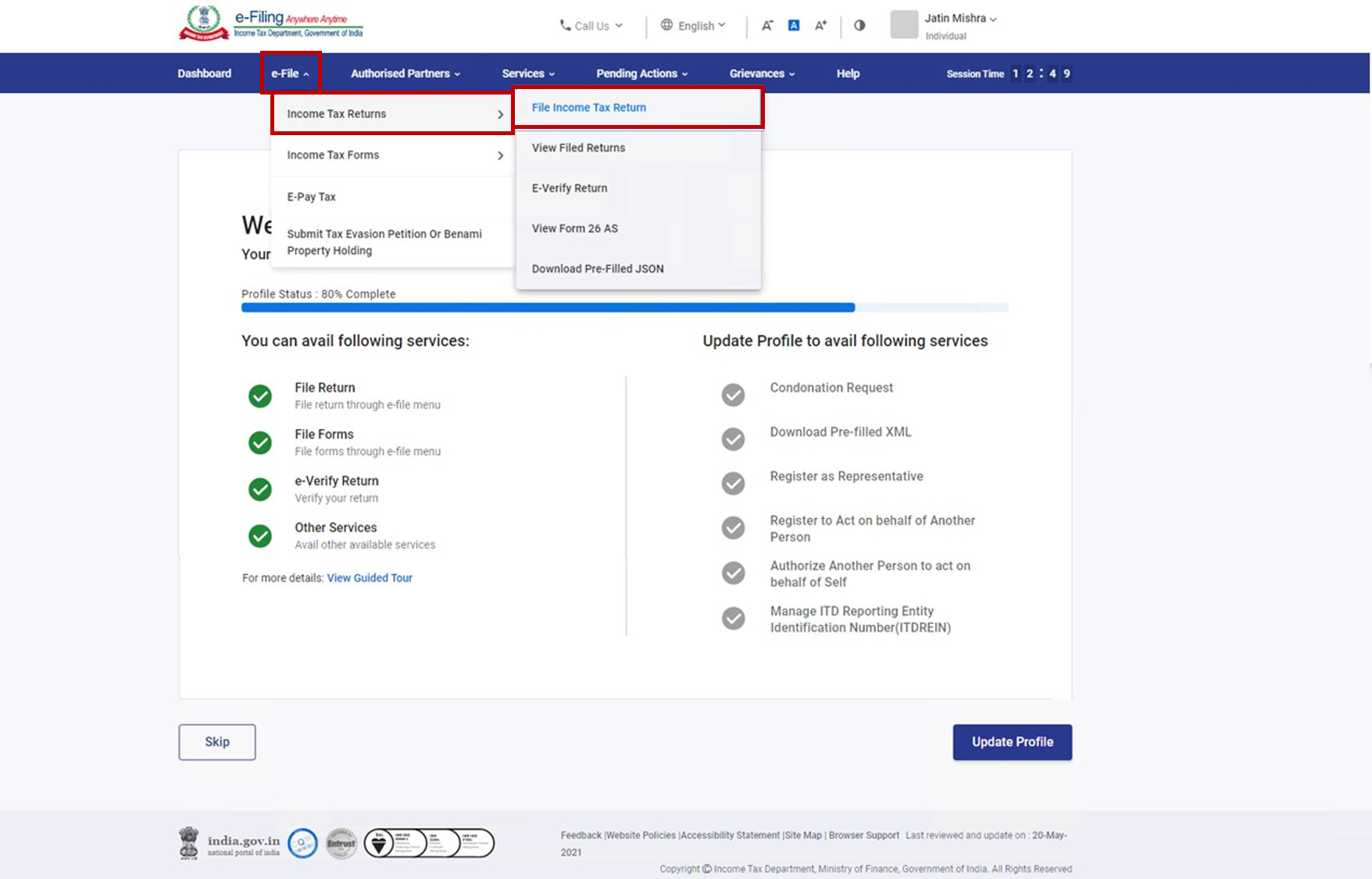

Step 2: On your Dashboard, click e-File > Income Tax Returns > File Income Tax Return.

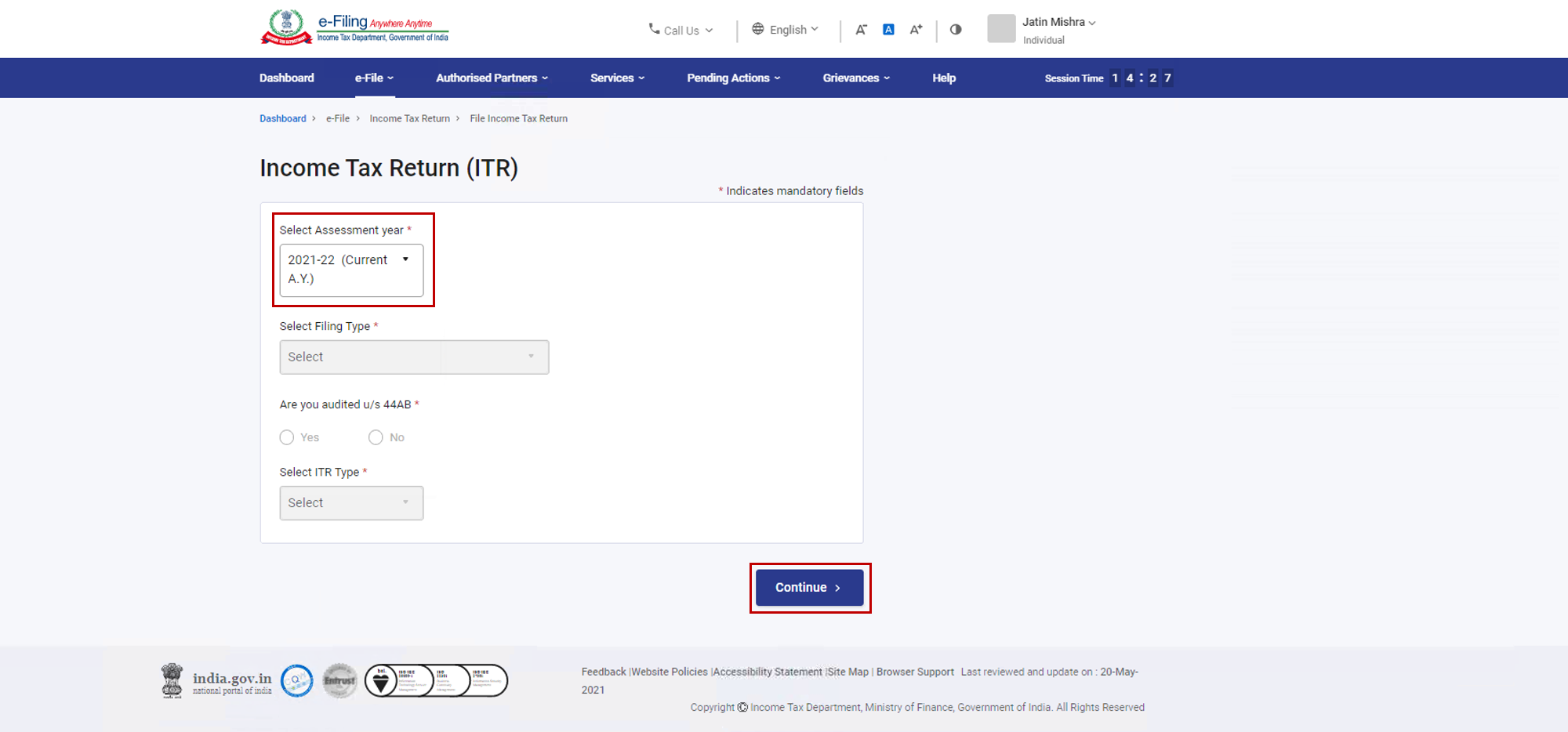

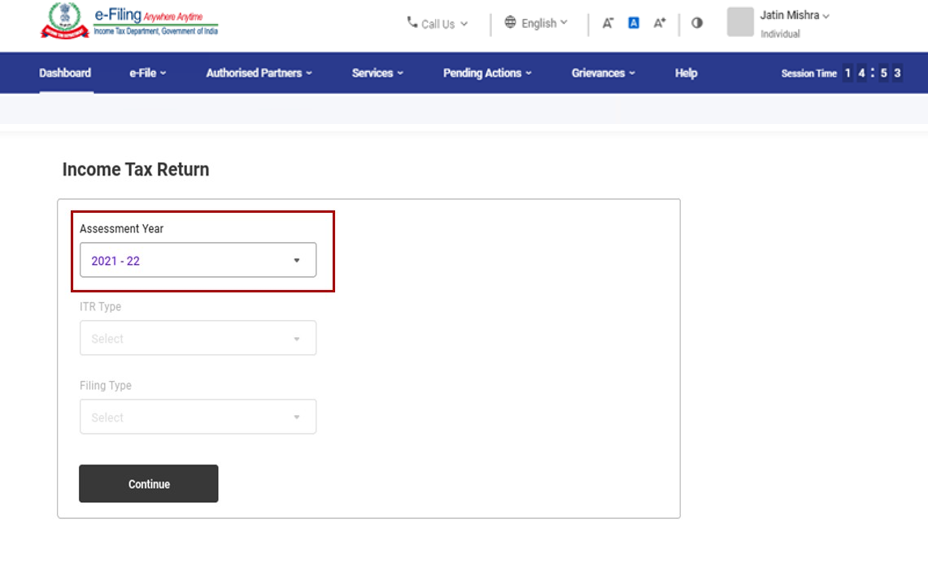

Step 3: Select Assessment Year as 2021 – 22 and click Continue.

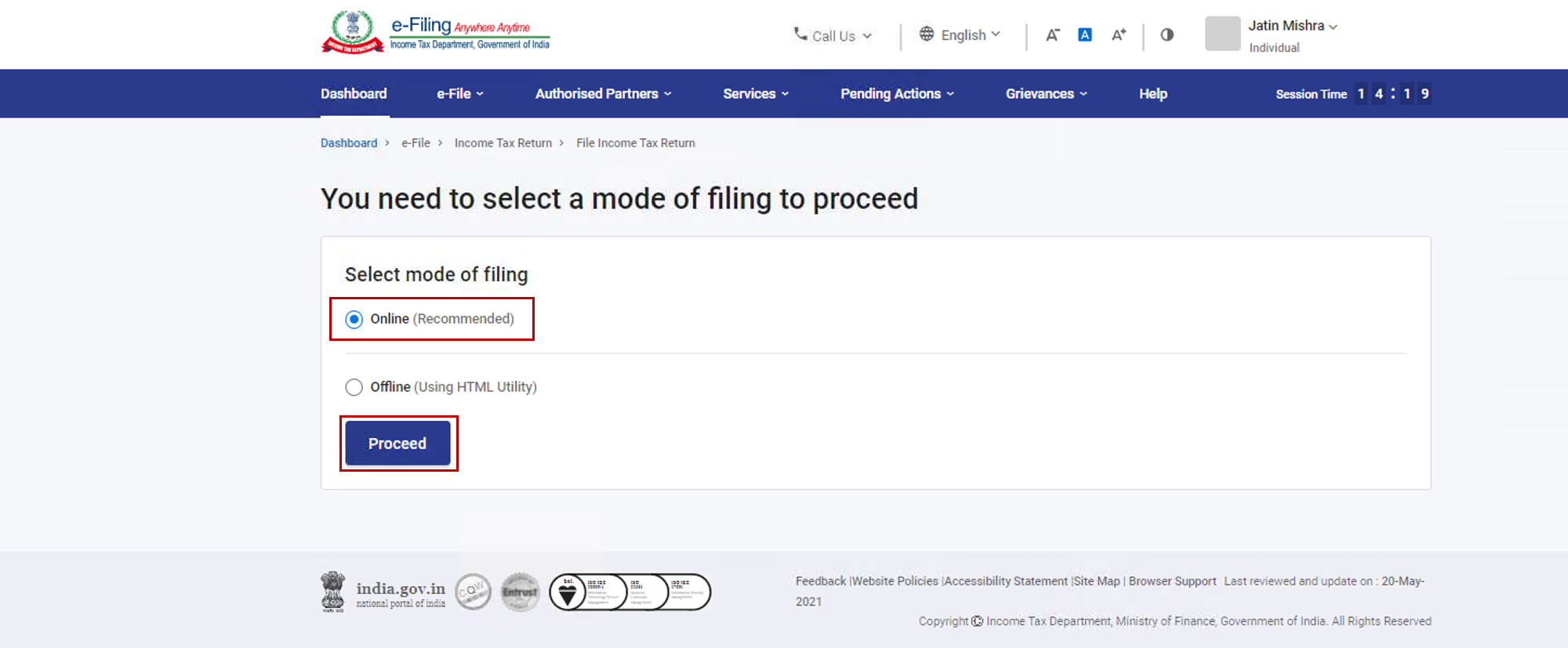

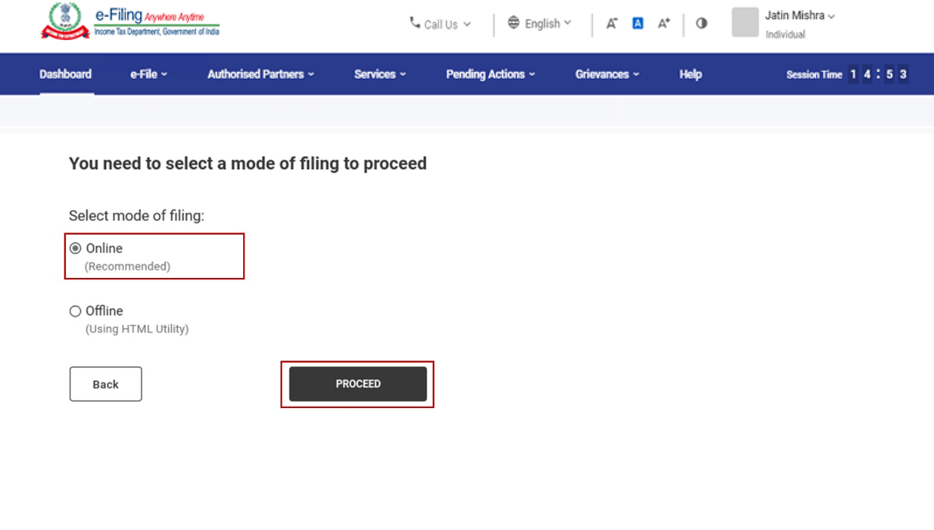

Step 4: Select Mode of Filing as Online and click Proceed.

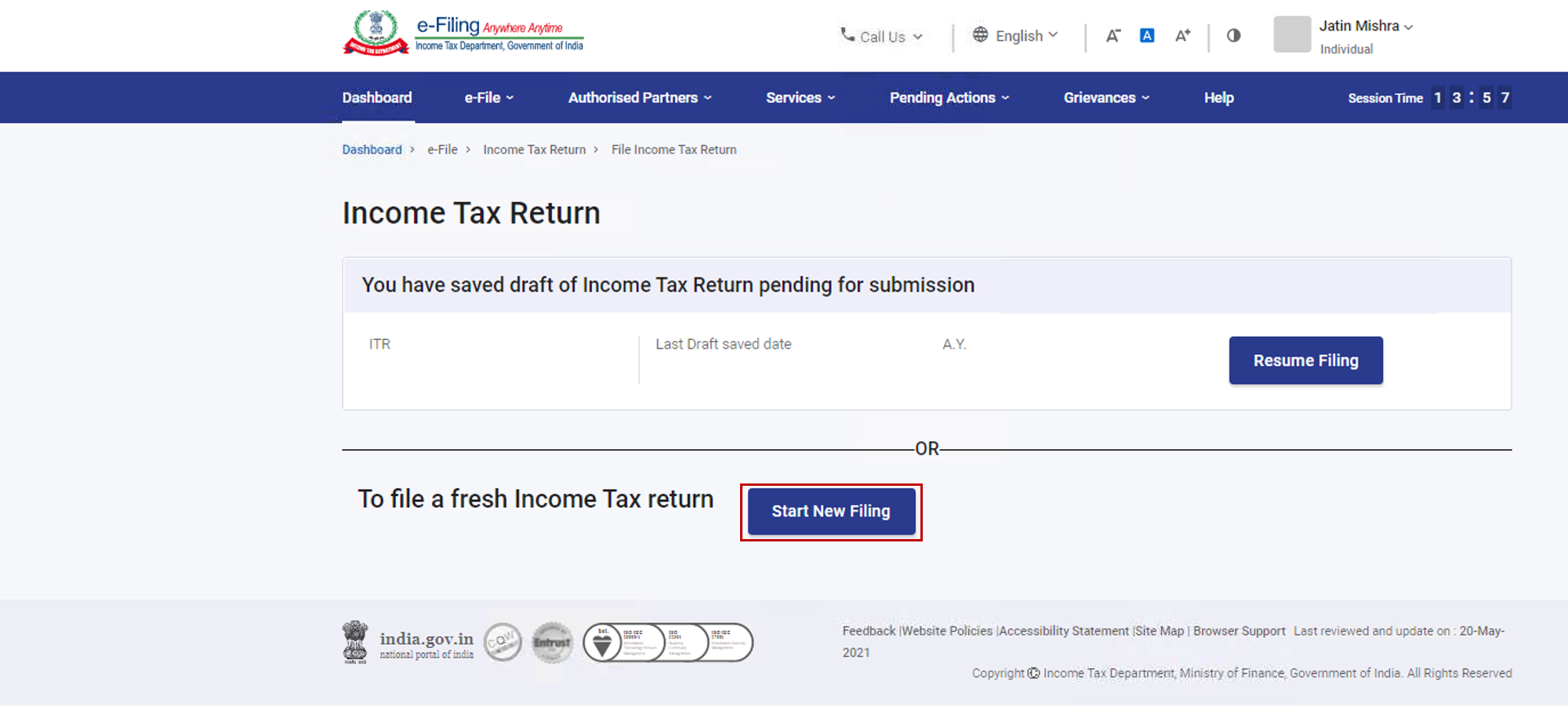

Note: In case you have already filled the Income Tax Return and it is pending for submission, click Resume Filing. In case you wish to discard the saved return and start preparing the return afresh click Start New Filing.

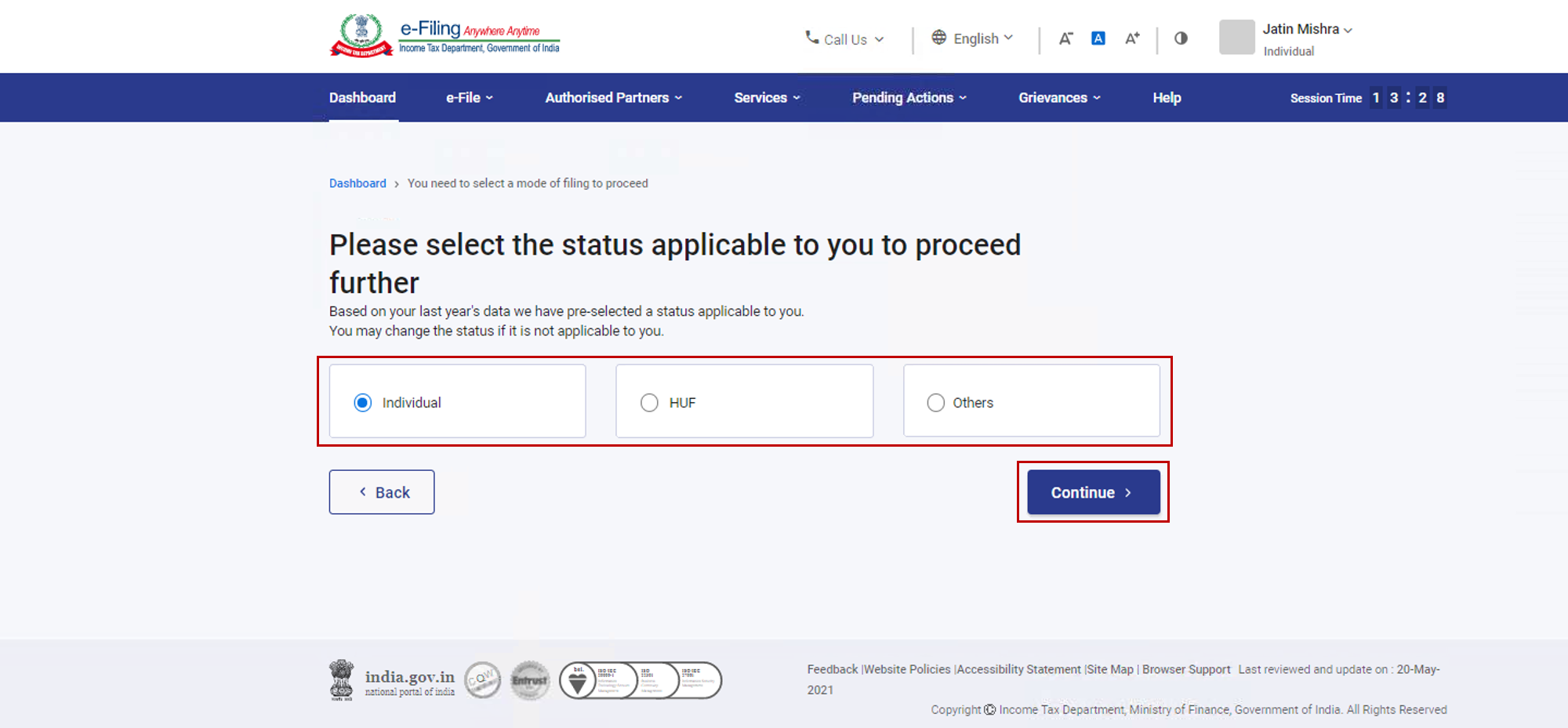

Step 5: Select Status as applicable to you and click Continue to proceed further.

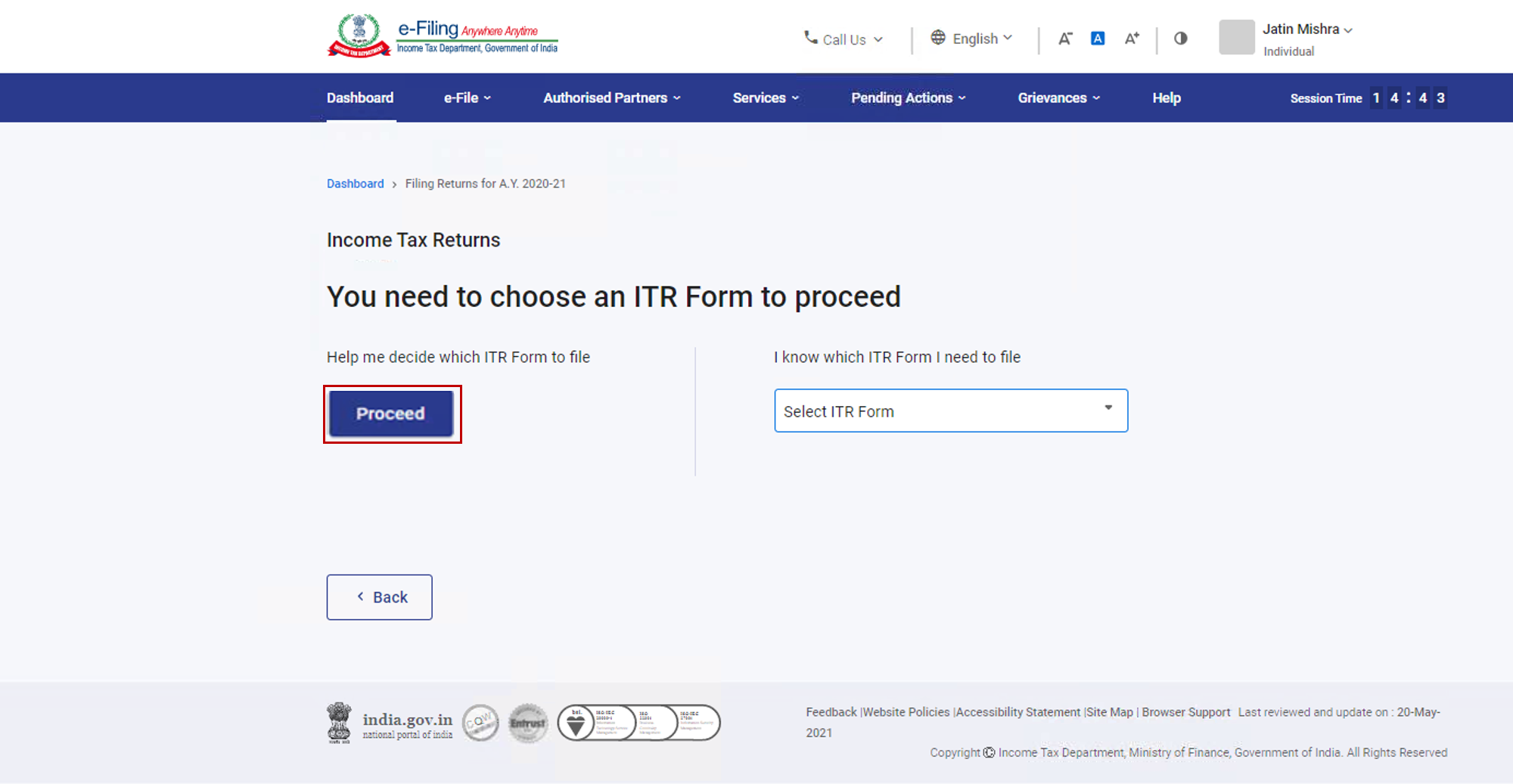

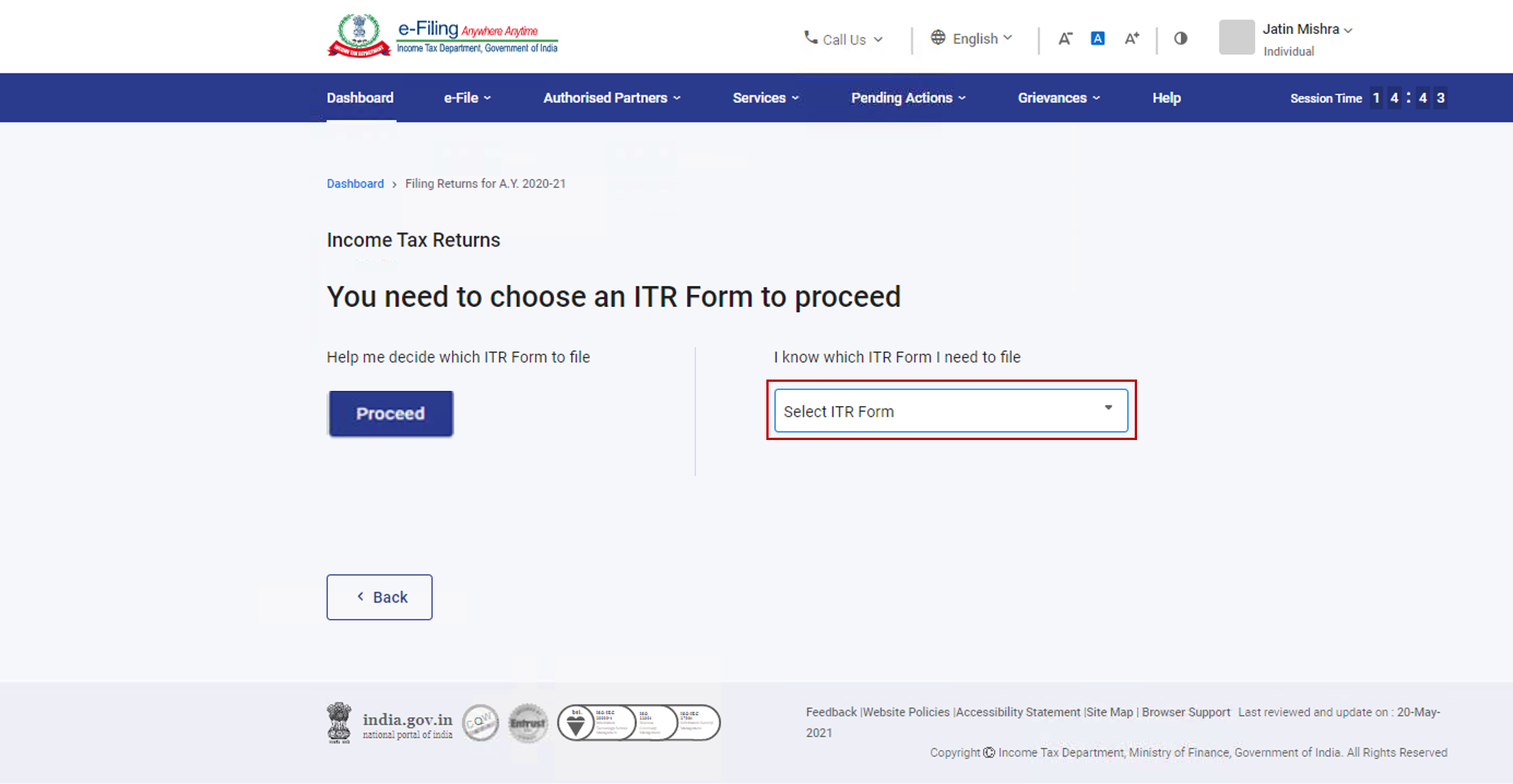

Step 6: You have two options to select the type of Income Tax Return:

- If you are not sure which ITR to file, you may select Help me decide which ITR Form to file and click Proceed. Once the system helps you determine the correct ITR, you can proceed with filing your ITR.

- If you are sure which ITR to file, select I know which ITR Form I need to file. Select the applicable Income Tax Return from the dropdown and click Proceed with ITR.

Note:

- In case you are not aware which ITR or schedules are applicable to you or income and deductions details, your answers in response to a set of questions will guide in determining the same and help you in correct / error free filing of ITR.

- In case you are aware of the ITR or schedules applicable to you or income and deduction details, you can skip these questions.

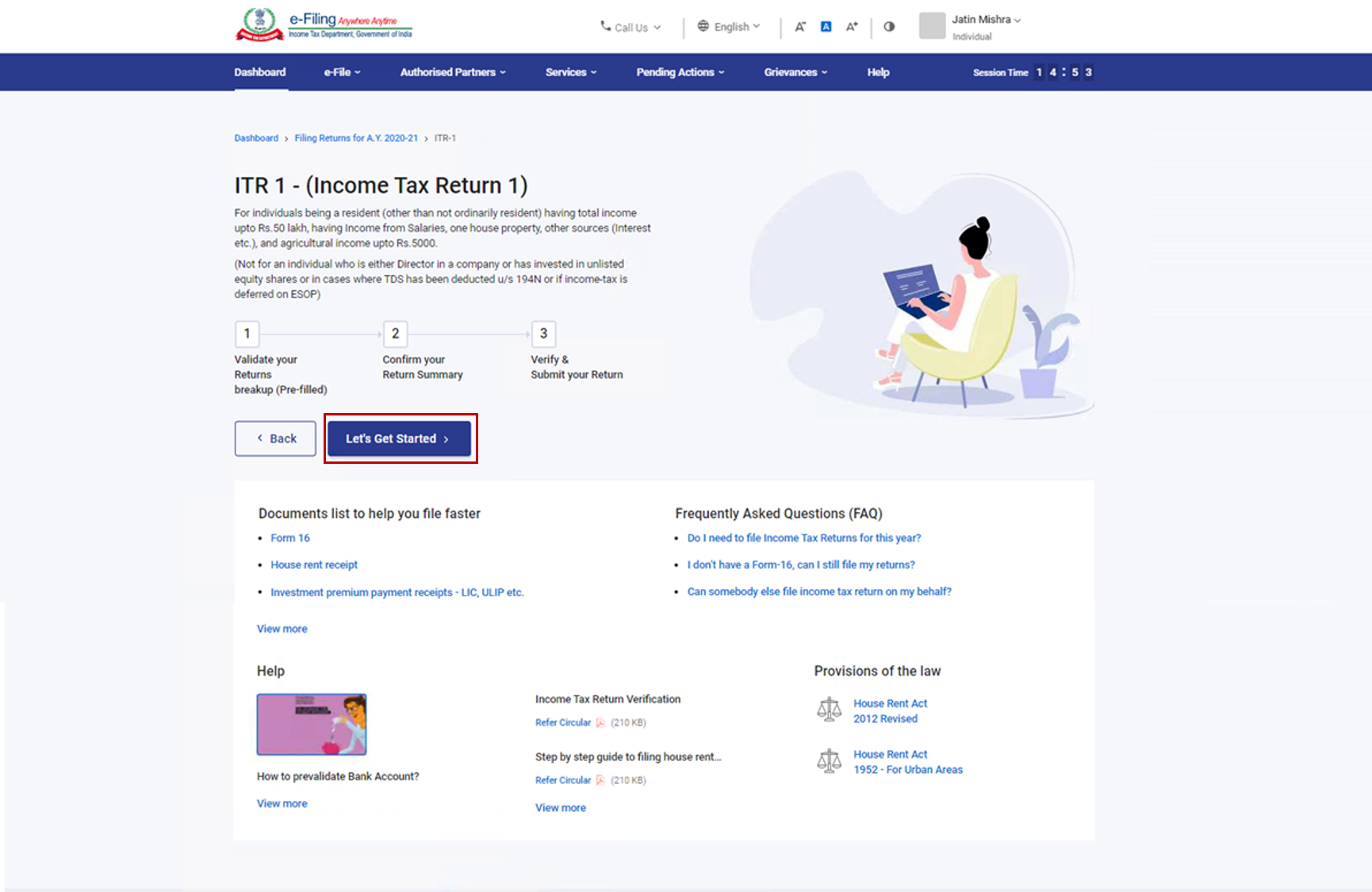

Step 7: Once you have selected the ITR applicable to you, note the list of documents needed and click Let’s Get Started.

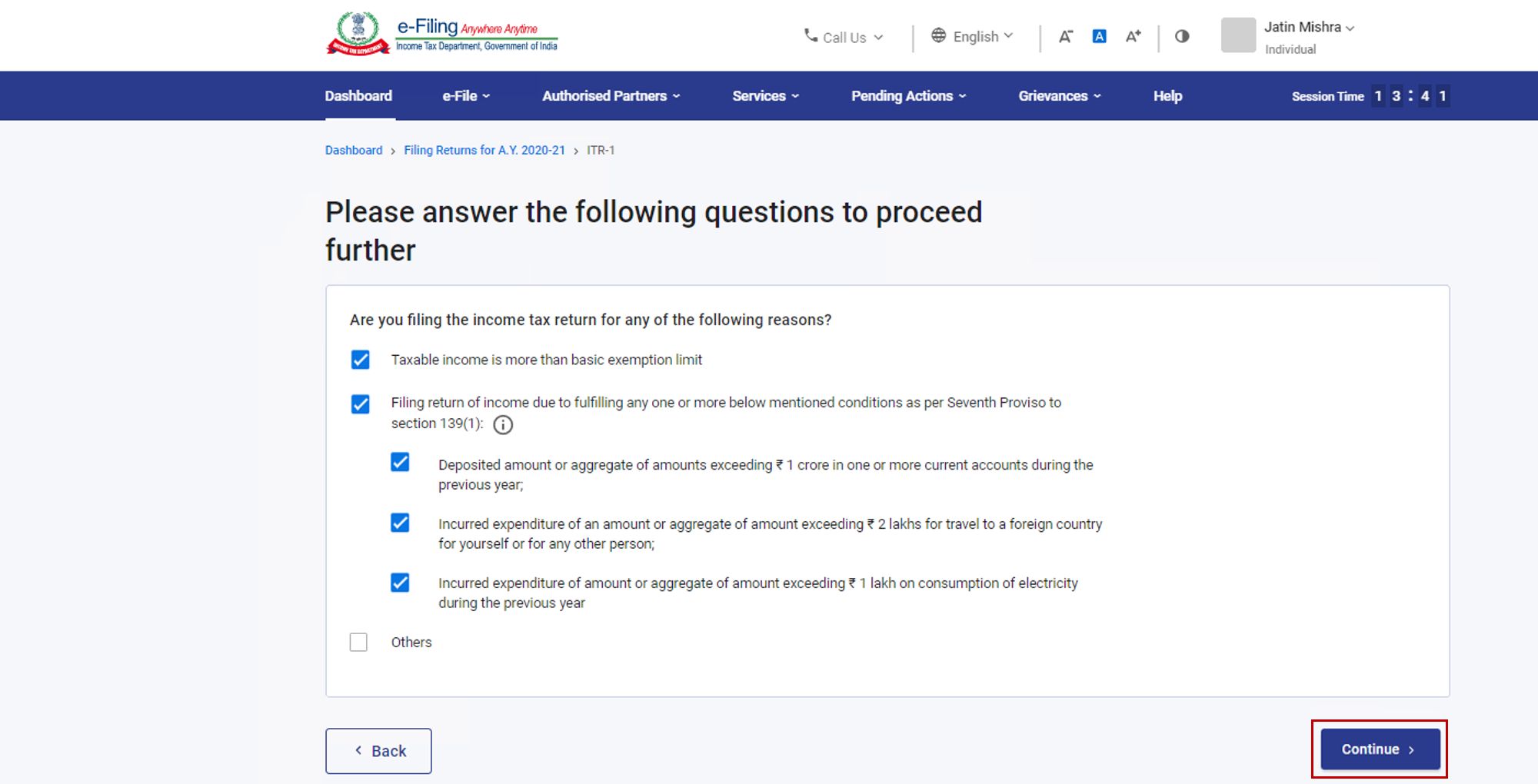

Step 8: Select the checkboxes applicable to you and click Continue.

Step 9: Review your pre-filled data and edit it if necessary. Enter the remaining / additional data (if required). Click Confirm at the end of each section.

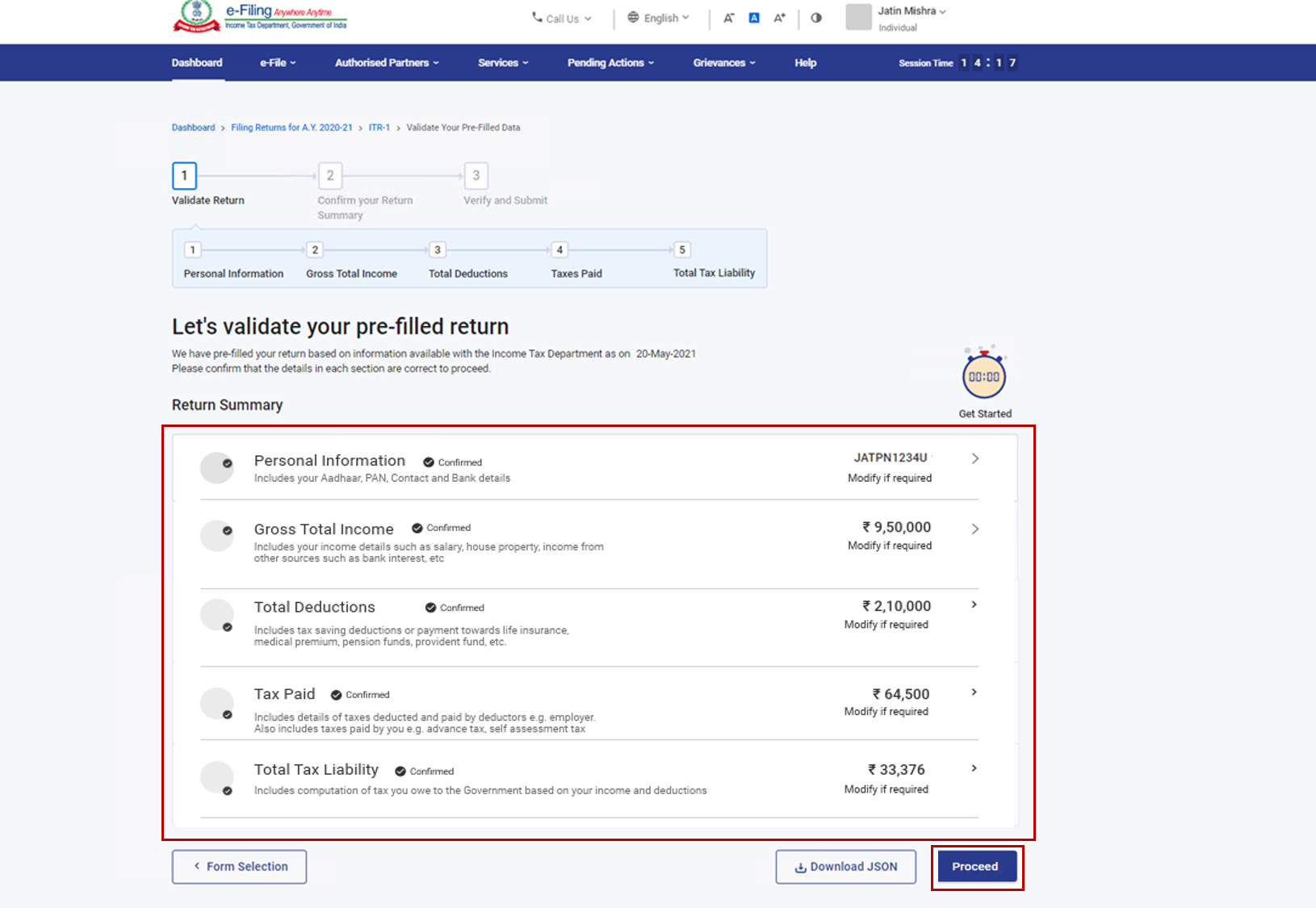

Step 10: Enter your income and deduction details in the different section. After completing and confirming all the sections of the form, click Proceed.

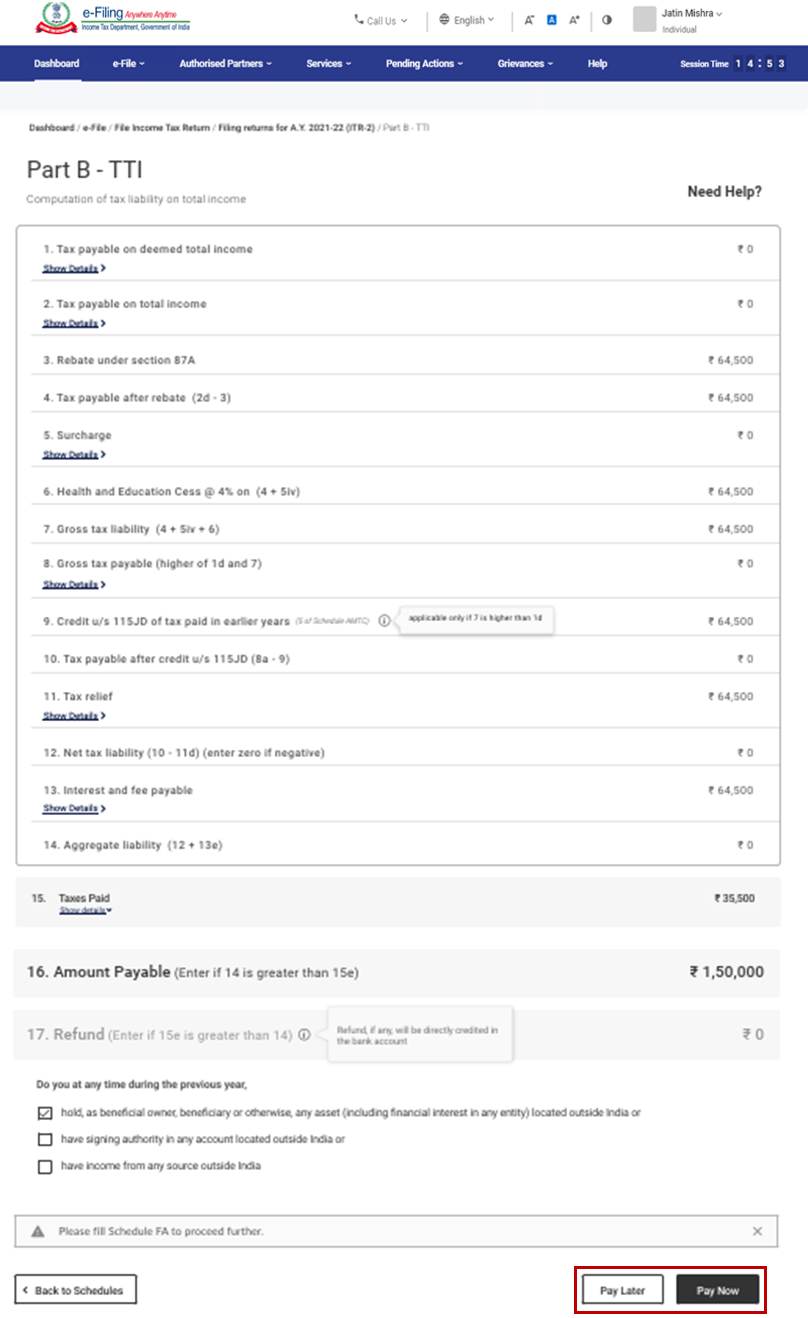

Step 10a: In case there is a tax liability

You will be shown a summary of your tax computation based on the details provided by you. If there is tax liability payable based on the computation, you get the Pay Now and Pay Later options at the bottom of the page.

Note:

- It is recommended to use the Pay Now option. Carefully note the BSR Code and Challan Serial Number and enter them in the details of payment.

- If you opt to Pay Later, you can make the payment after filing your Income Tax Return, but there is a risk of being considered as an assessee in default, and liability to pay interest on tax payable may arise.

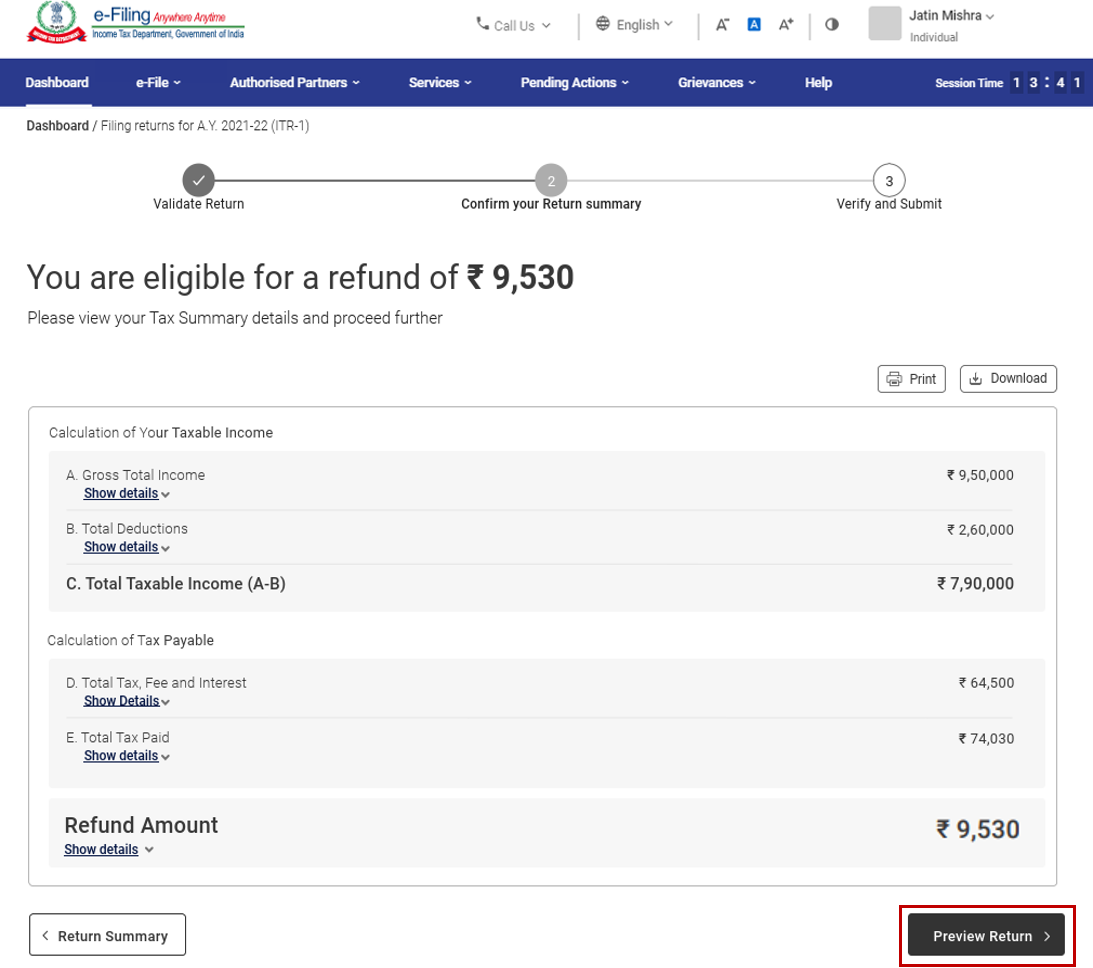

Step 10b: In case there is no tax liability (No Demand / No Refund) or if you are eligible for a Refund

After paying tax, click Preview Return. If there is no tax liability payable, or if there is a refund based on tax computation, you will be taken to the Preview and Submit Your Return page.

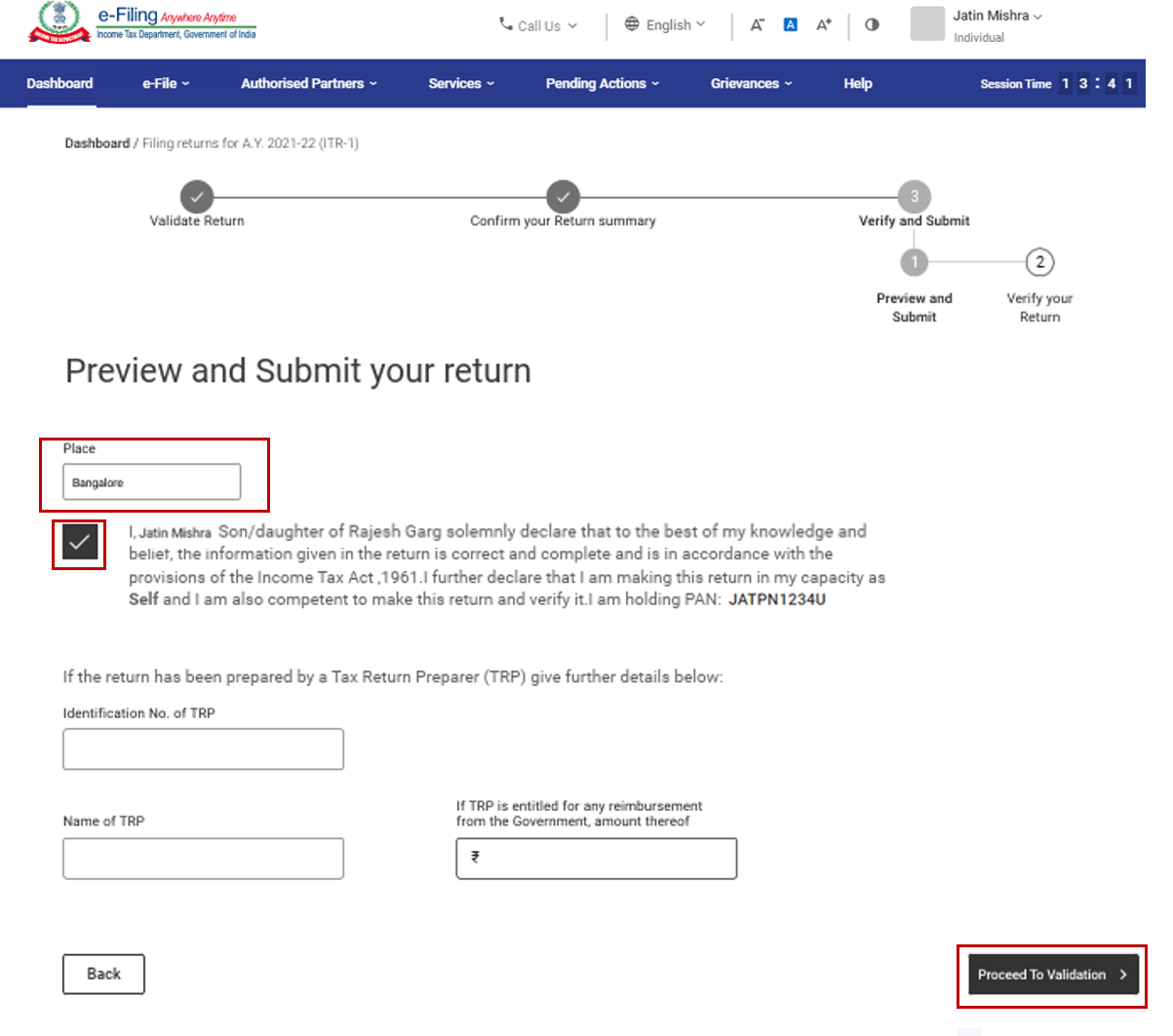

Step 11: On the Preview and Submit Your Return page, enter Place, select the declaration checkbox and click Proceed to Validation.

Note: If you have not involved a tax return preparer or TRP in preparing your return, you can leave the textboxes related to TRP blank.

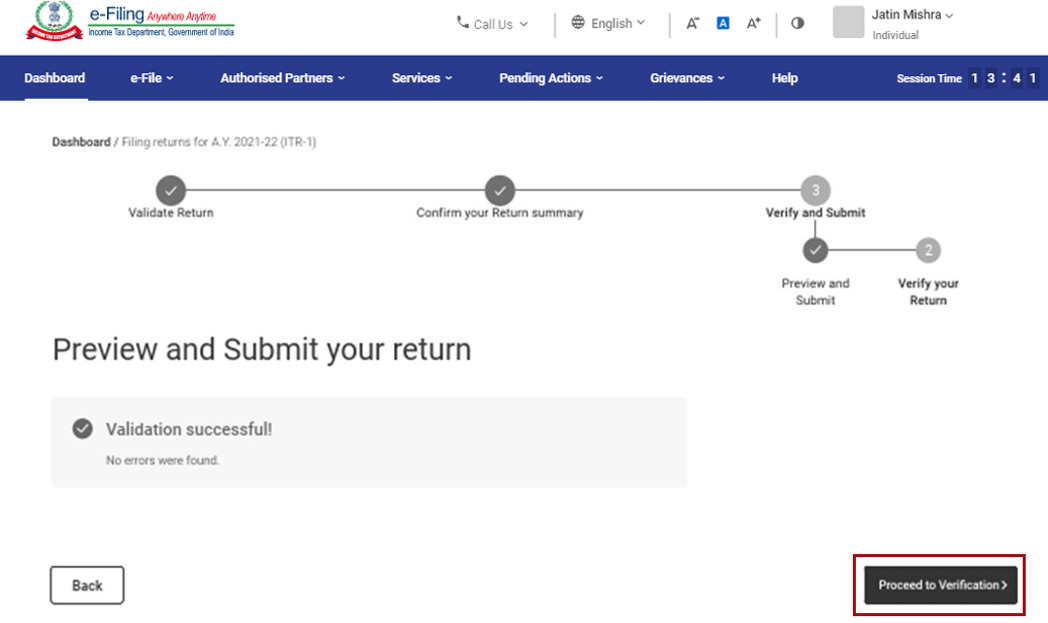

Step 12: Once validated, on your Preview and Submit your Return page, click Proceed to Verification.

Note: If you are shown a list of errors in your return, you need to go back to the form to correct the errors. If there are no errors, you can proceed to e-Verify your return by clicking Proceed to Verification.

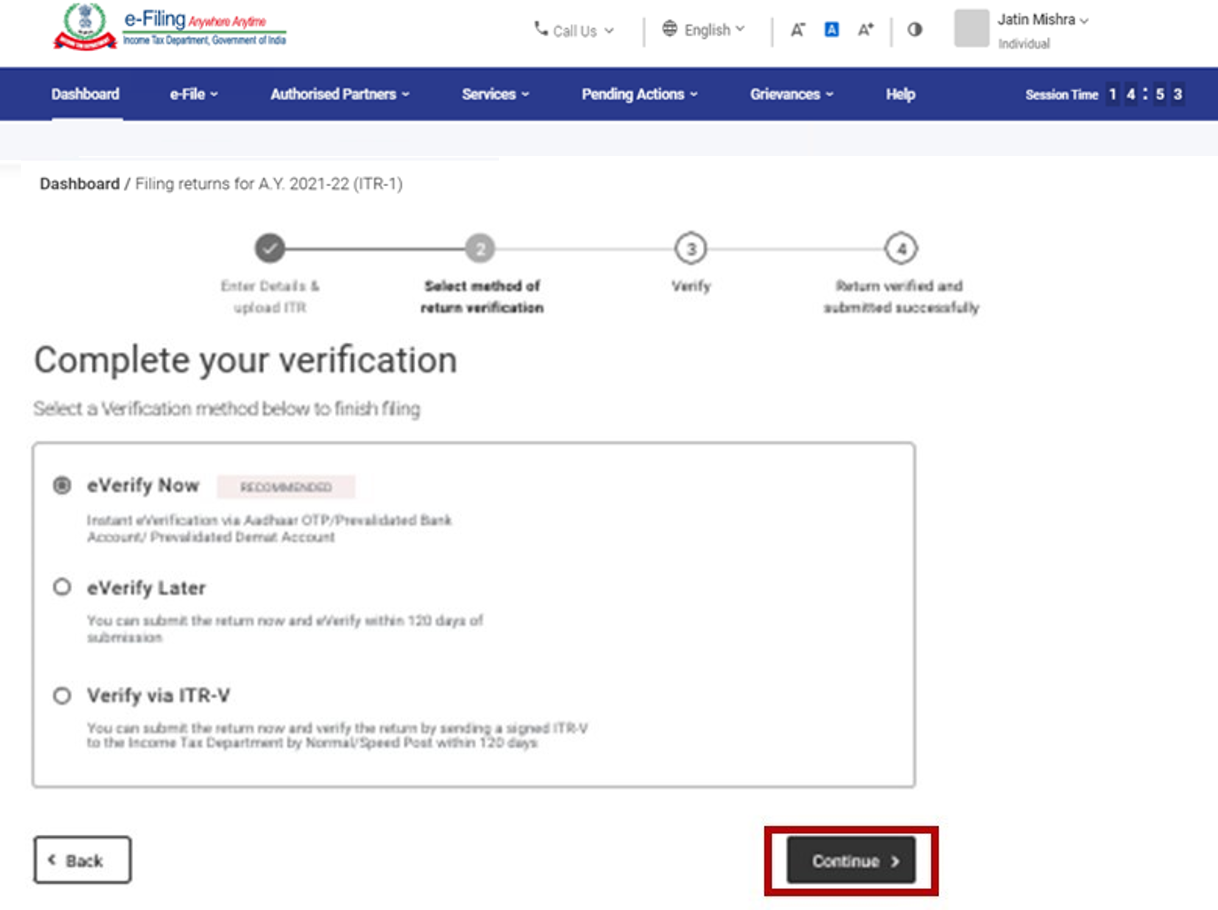

Step 13: On the Complete your Verification page, select your preferred option and click Continue.

It is mandatory to verify your return, and e-Verification (recommended option – e-Verify Now) is the easiest way to verify your ITR – it is quick, paperless, and safer than sending a signed physical ITR-V to CPC by post.

Note: In case you select e-Verify Later, you can submit your return, however, you will be required to verify your return within 120 days of filing of your ITR.

Step 14: On the e-Verify page, select the option through which you want to e-Verify the return and click Continue.

Note:

- Refer to the How to e-Verify user manual to learn more.

- If you select Verify via ITR-V, you need to send a signed physical copy of your ITR-V to Centralized Processing Center, Income Tax Department, Bengaluru 560500 by normal / speed post within 120 days.

- Please make sure you have pre-validated your bank account so that any refunds due maybe credited to your bank account.

- Refer to the My Bank Account user manual to learn more.

Once you e-Verify your return, a success message is displayed along with the Transaction ID and Acknowledgment Number. You will also receive a confirmation message on your mobile number and email ID registered on the e-Filing portal.

Step by Step guide to file ITR-2:

1. Overview

The pre-filling and filing of ITR-2 service is available to registered users on the e-Filing portal. This service enables individual taxpayers to file ITR-2 online through the e-Filing portal. This user manual covers filing of ITR-2 through online mode.

2. Prerequisites for availing this service

| General |

|

| Others |

|

ITR-2 has the following sections that you need to fill before submitting the form, a summary section where you review your tax computation and pay tax and finally submit the return for verification:

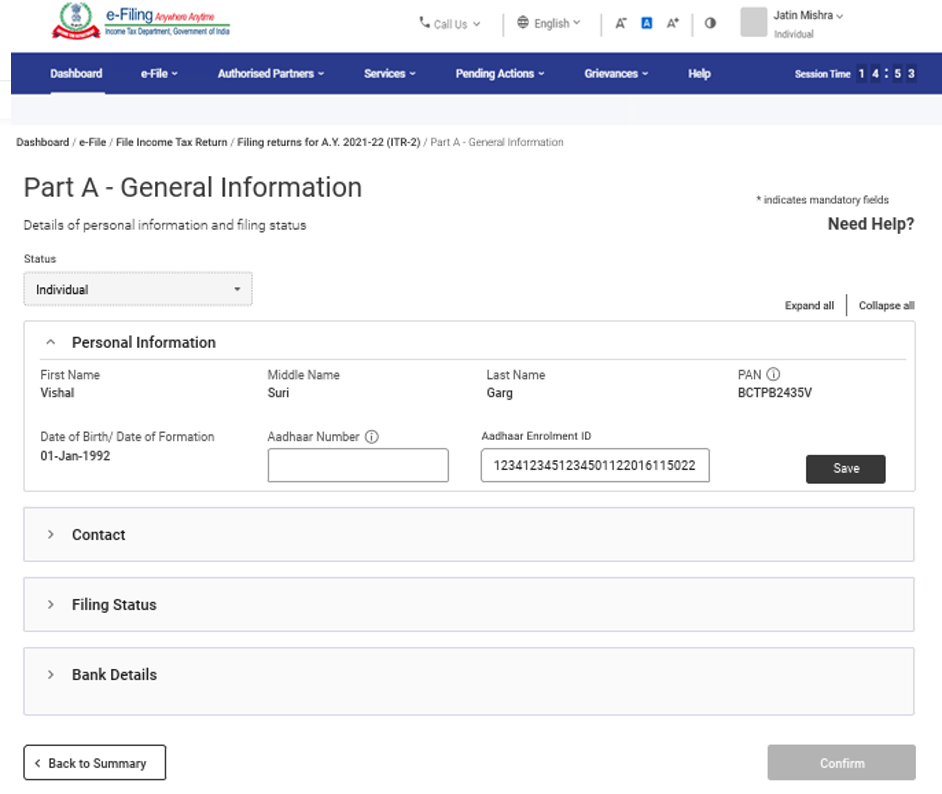

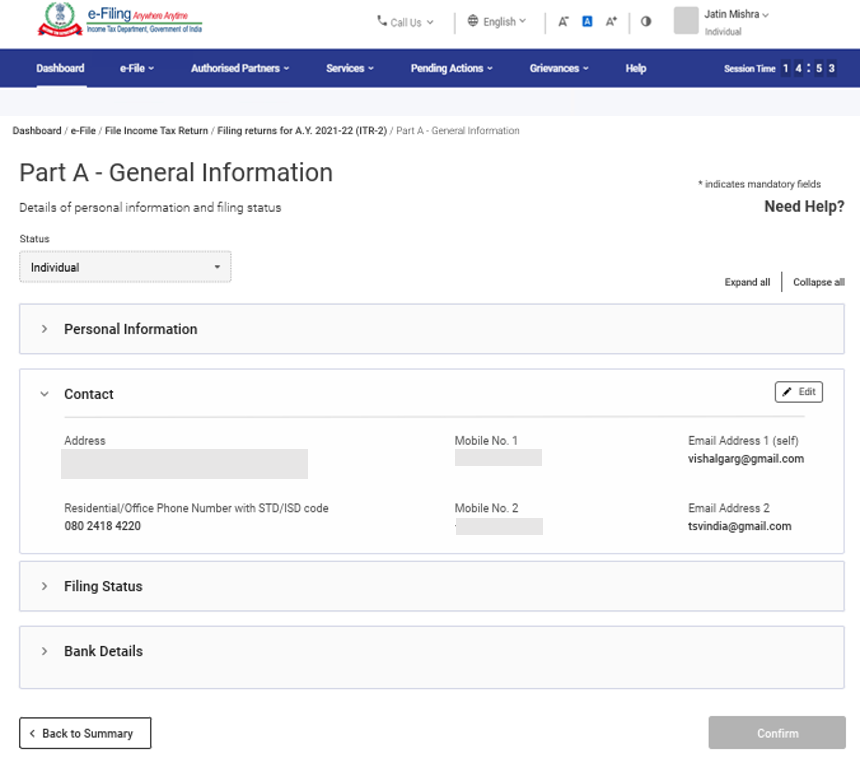

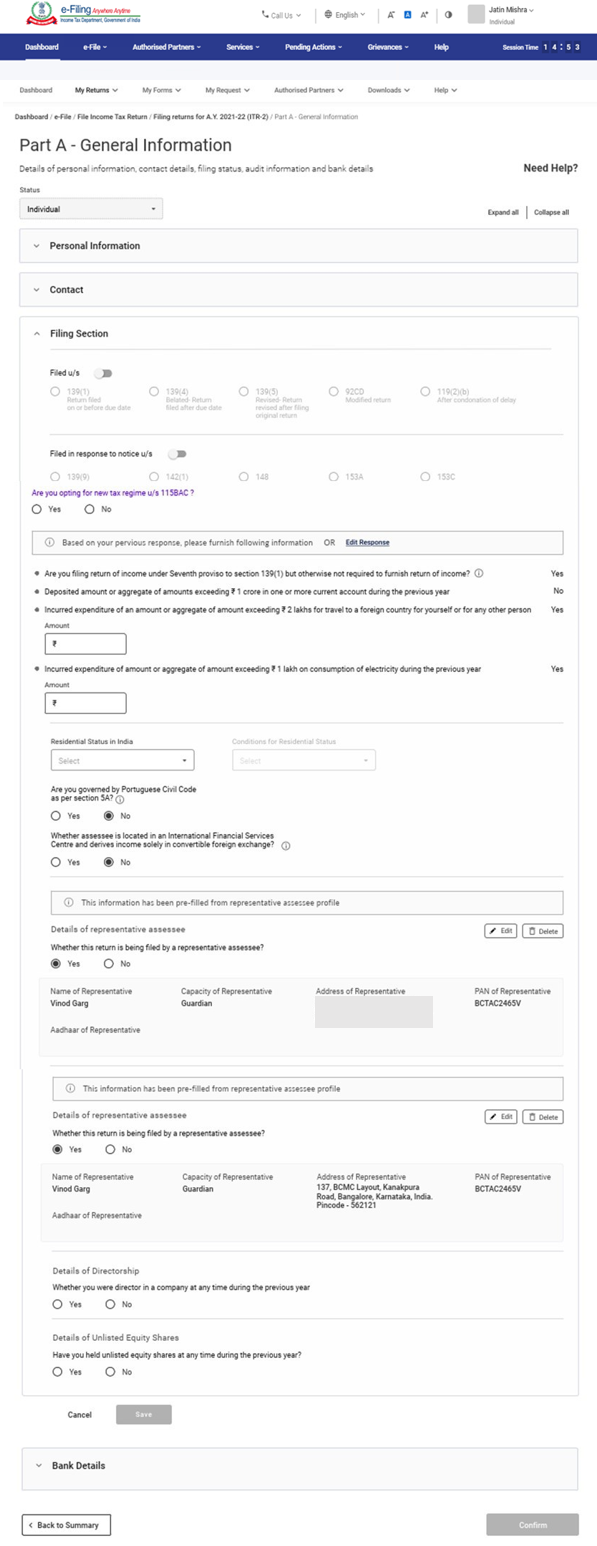

3.1 Part A General

3.2 Schedule Salary

3.3 Schedule House Property

3.4 Schedule Capital Gains

3.5 Schedule 112A and Schedule-115AD(1)(iii) proviso

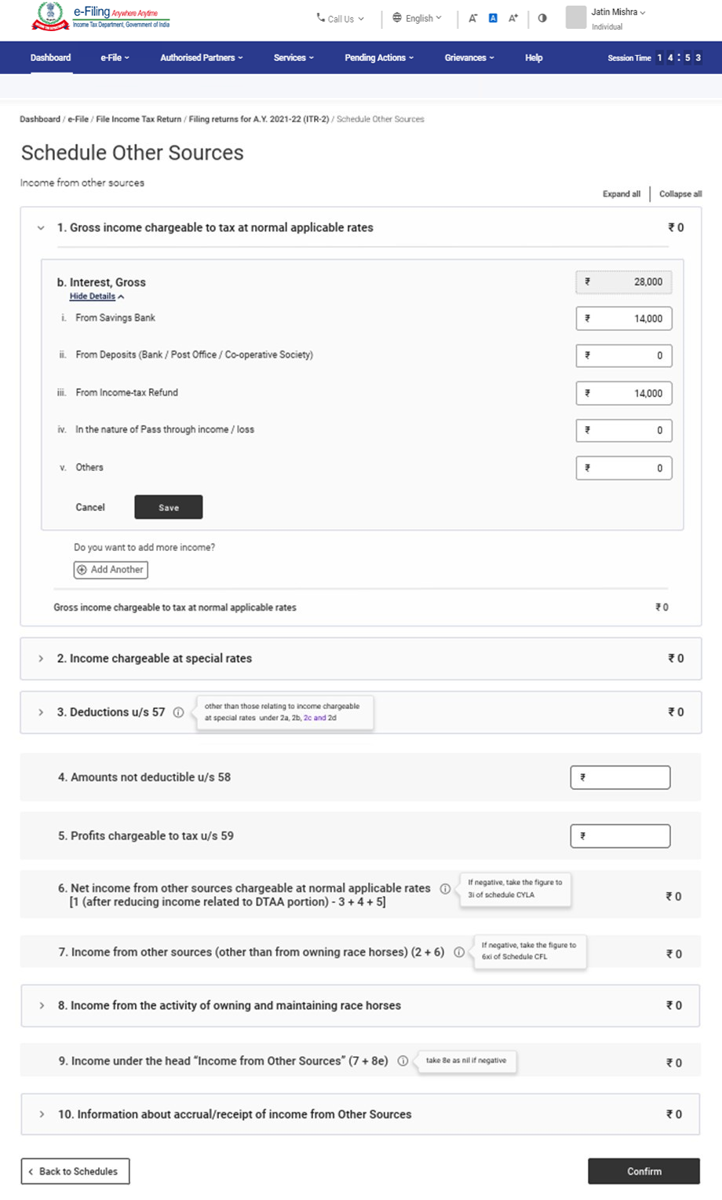

3.6 Schedule Other Sources

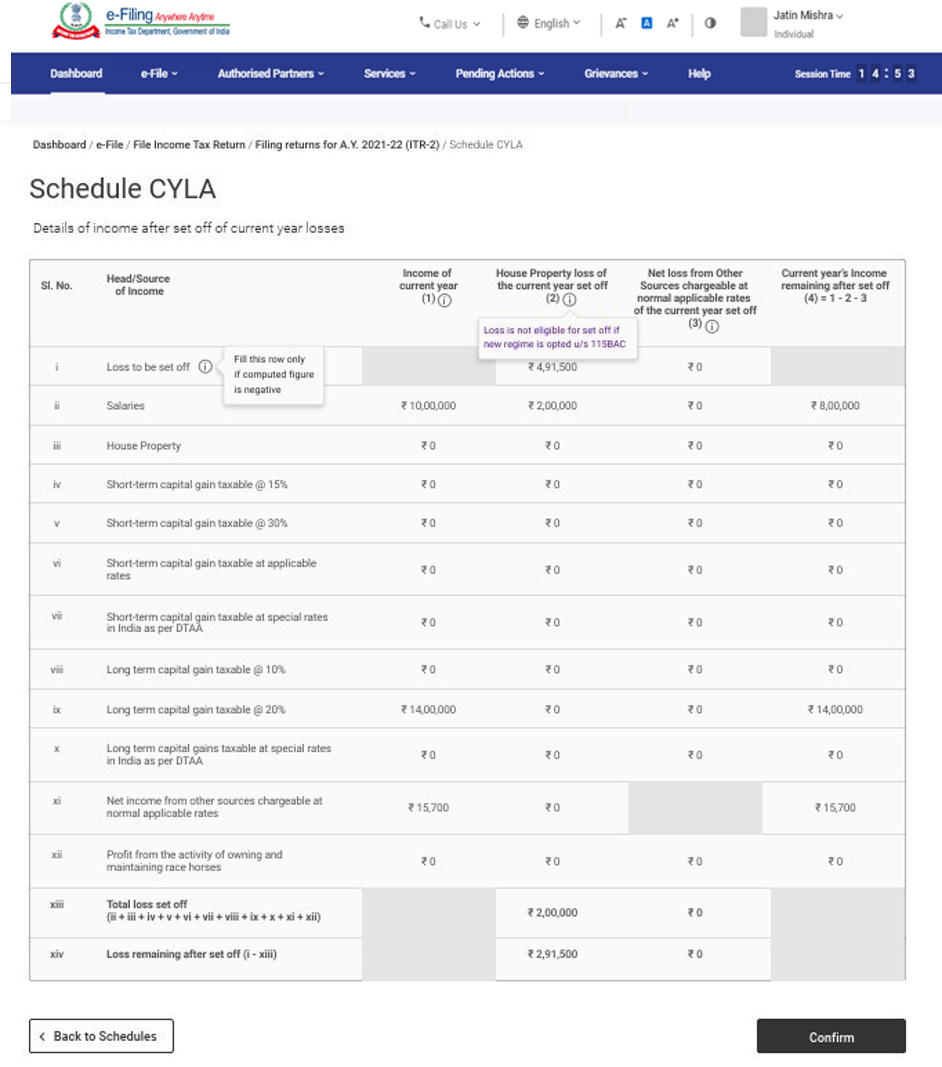

3.7 Schedule CYLA

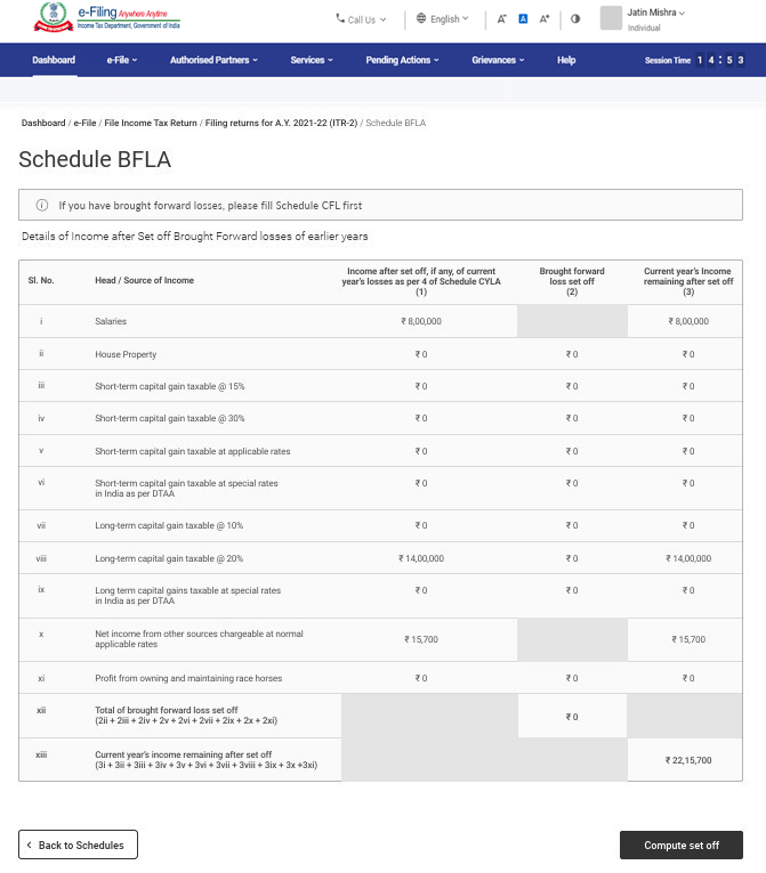

3.8 Schedule BFLA

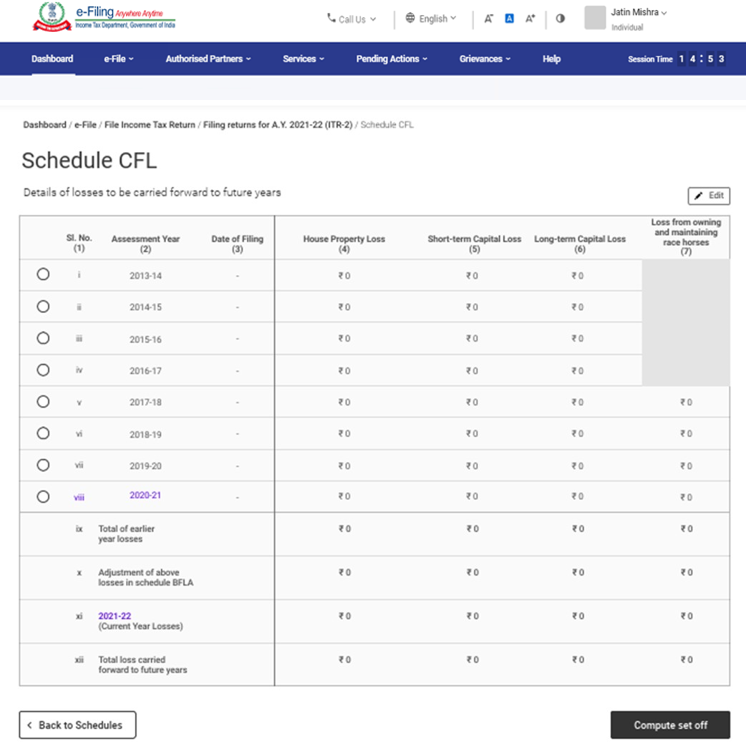

3.9 Schedule CFL

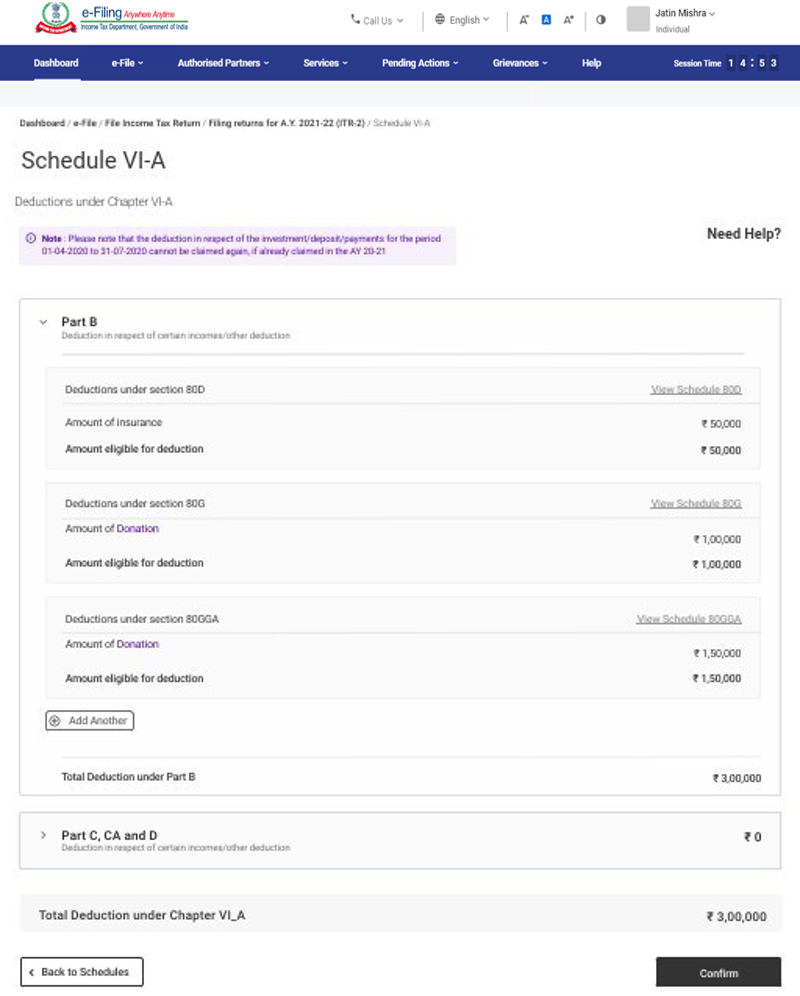

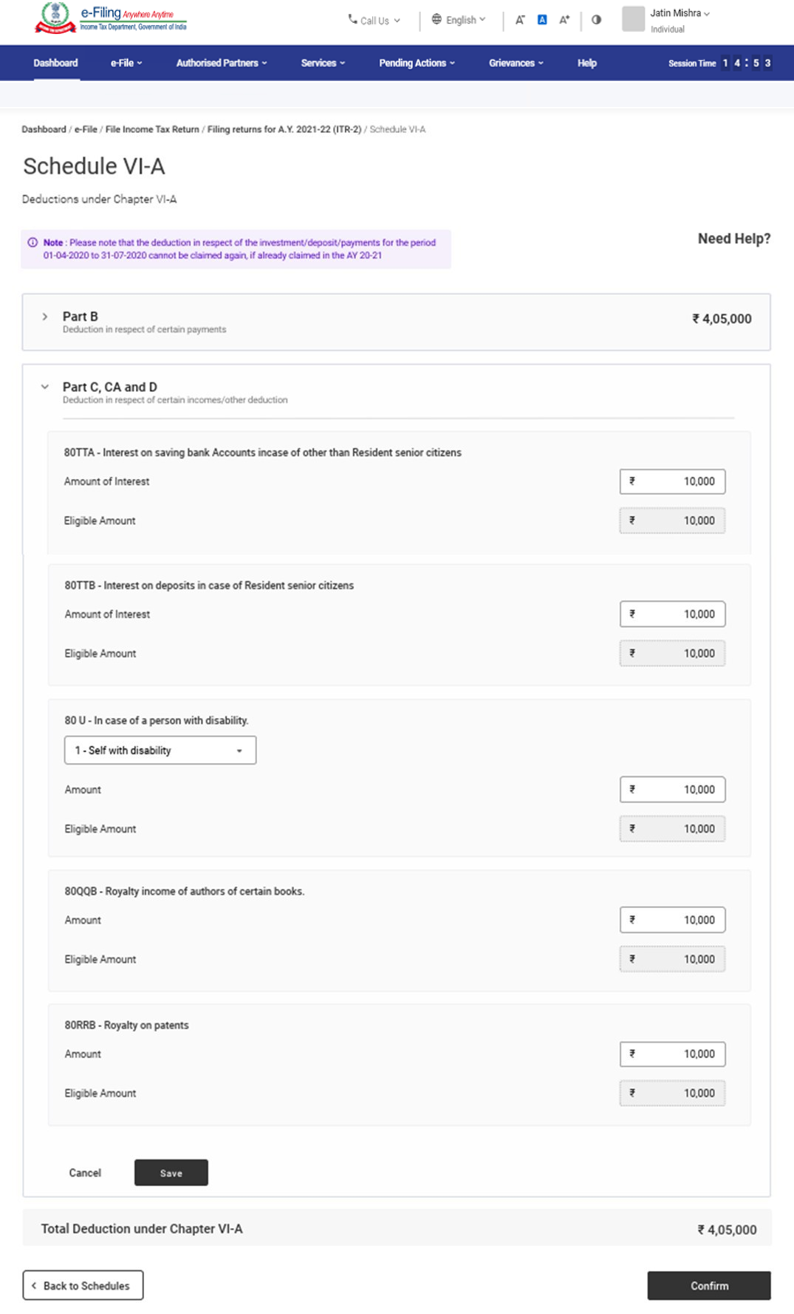

3.10 Schedule VI-A

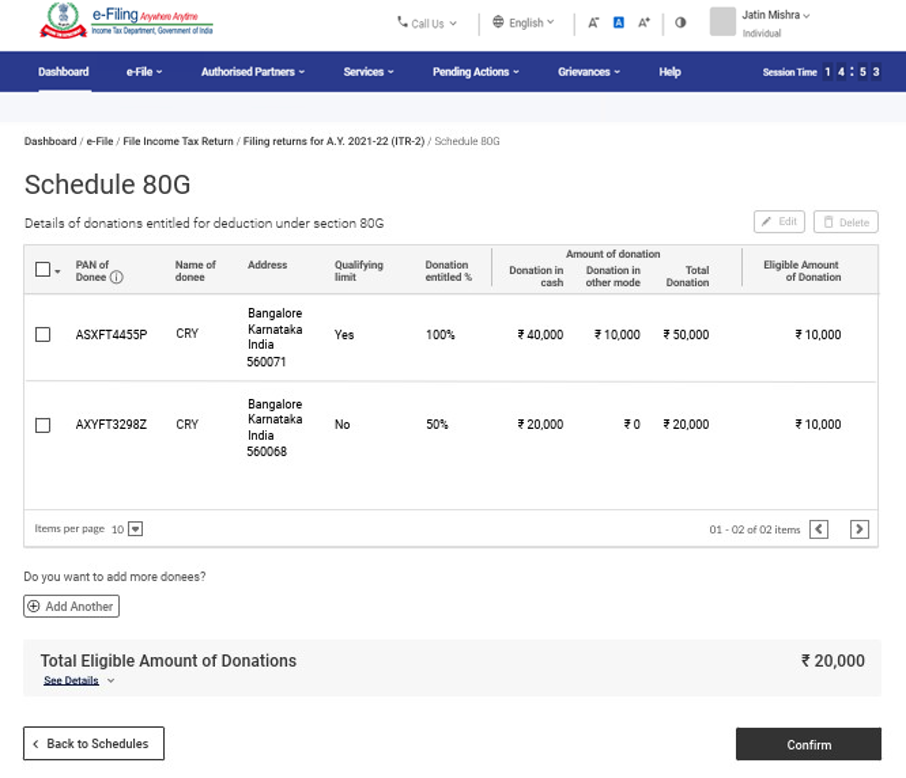

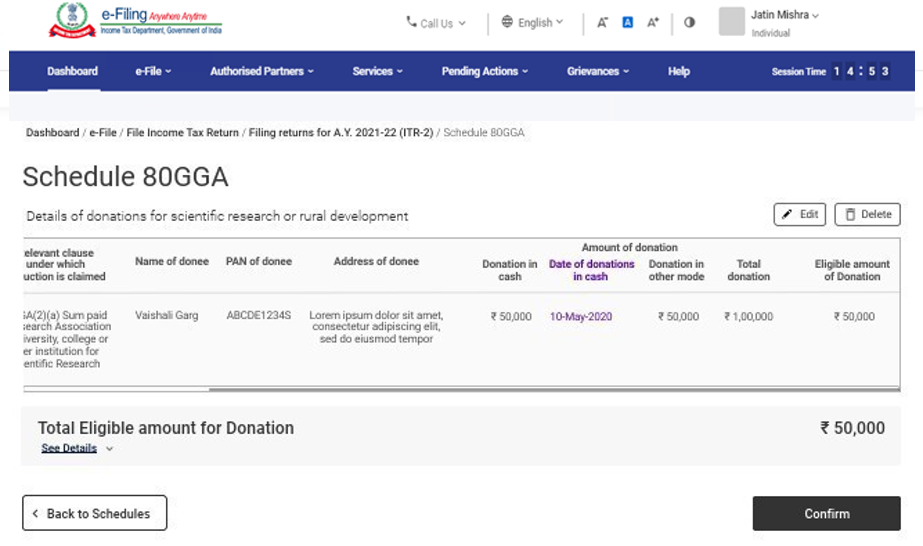

3.11 Schedule 80G and Schedule 80GGA

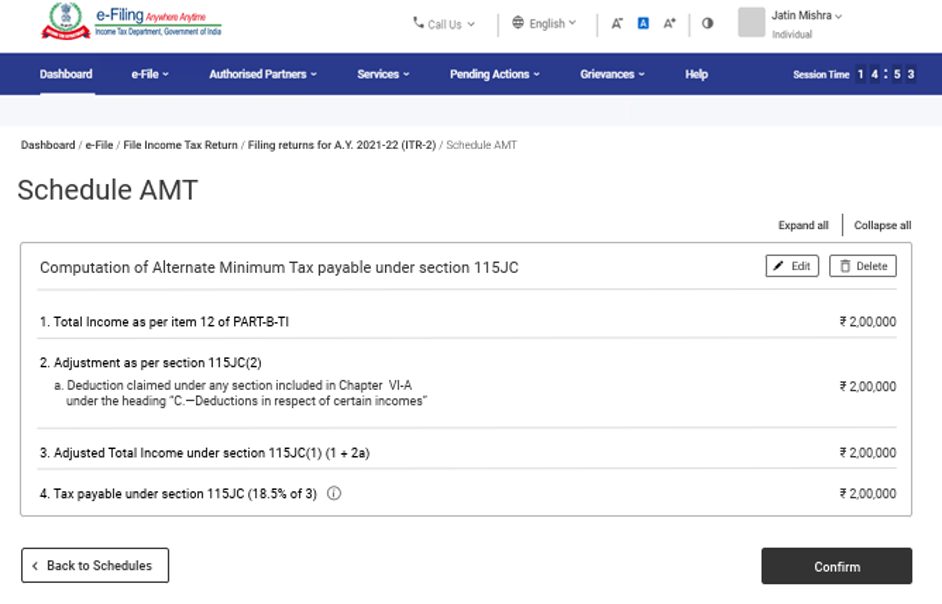

3.12 Schedule AMT

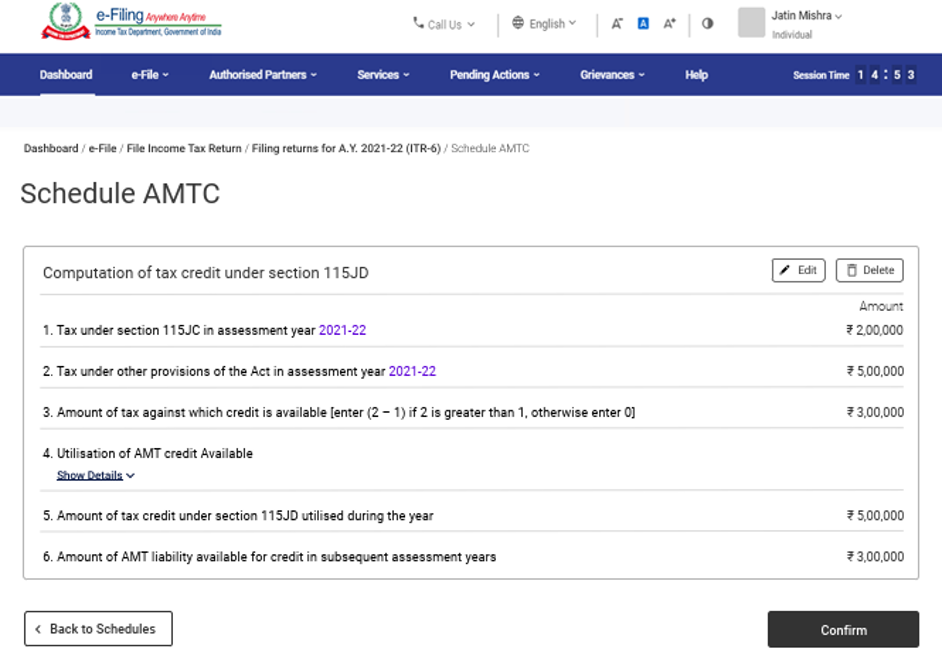

3.13 Schedule AMTC

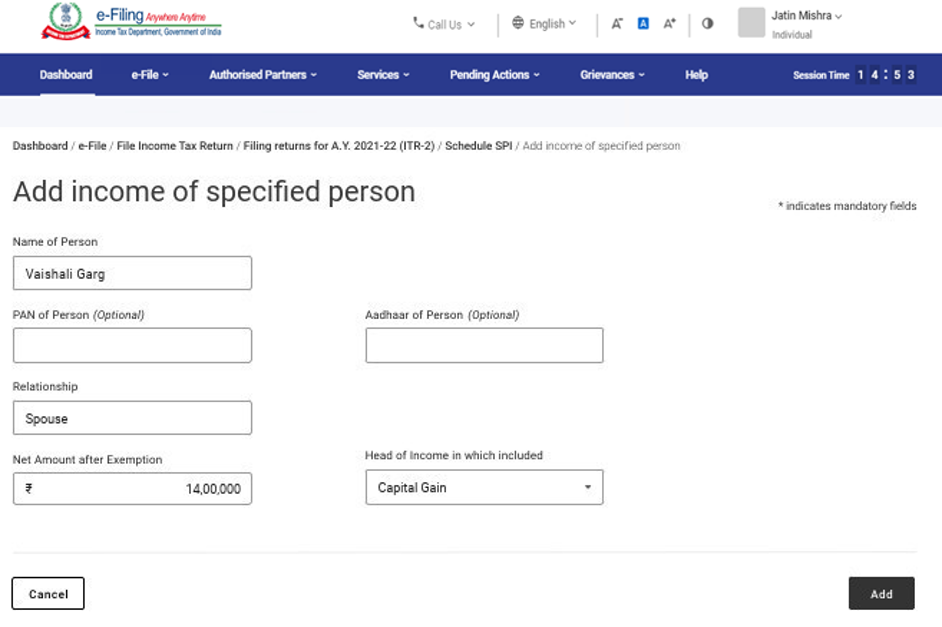

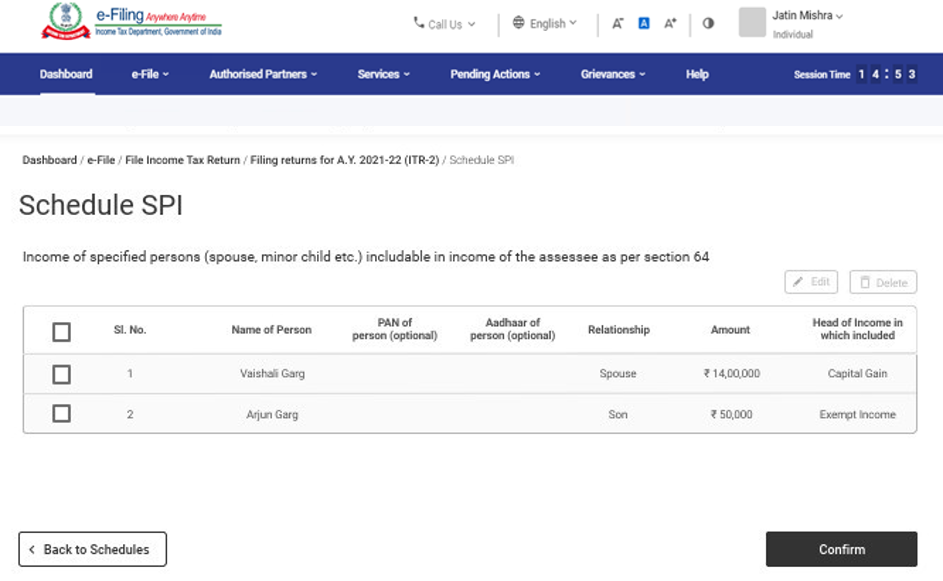

3.14 Schedule SPI

3.15 Schedule SI

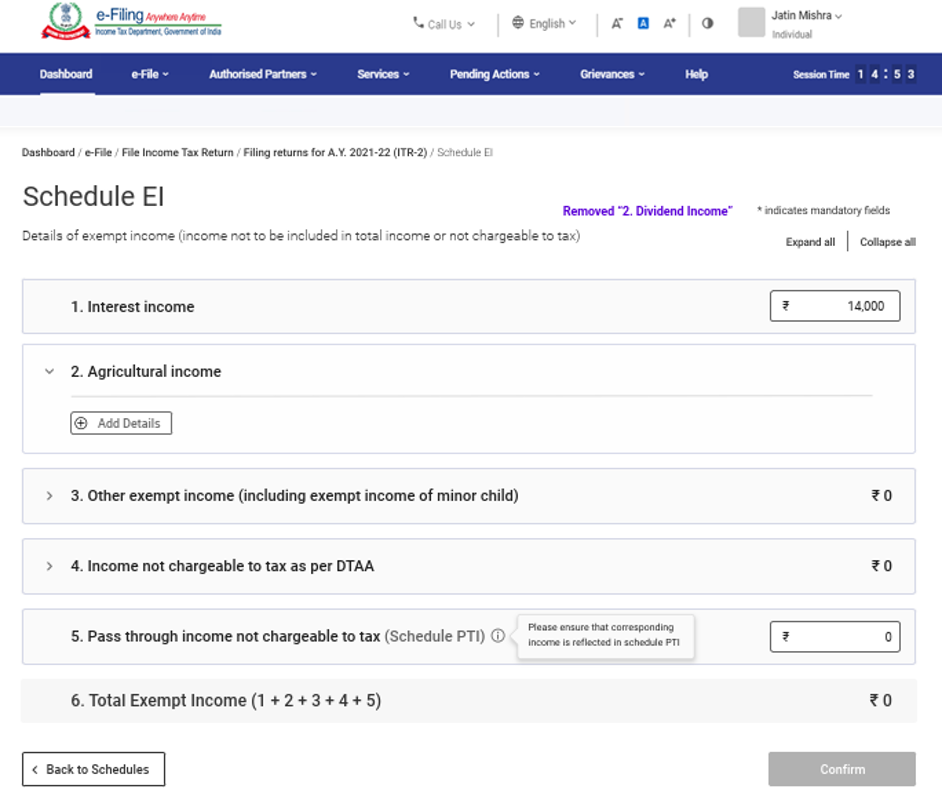

3.16 Schedule EI

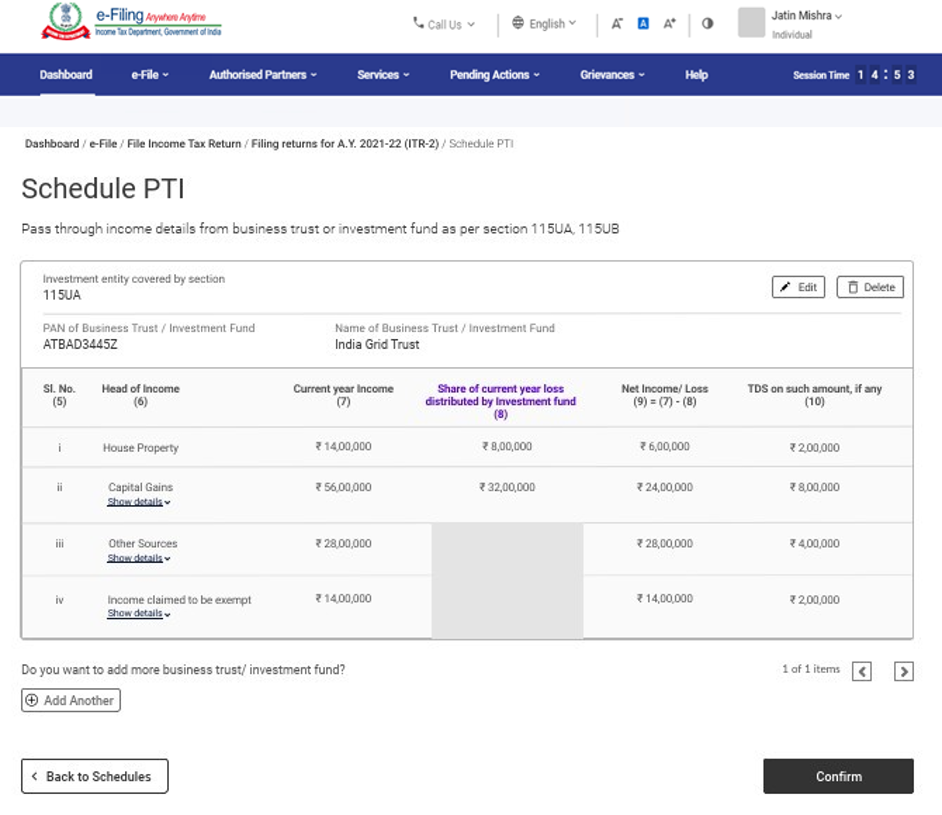

3.17 Schedule PTI

3.18 Schedule FSI

3.19 Schedule TR

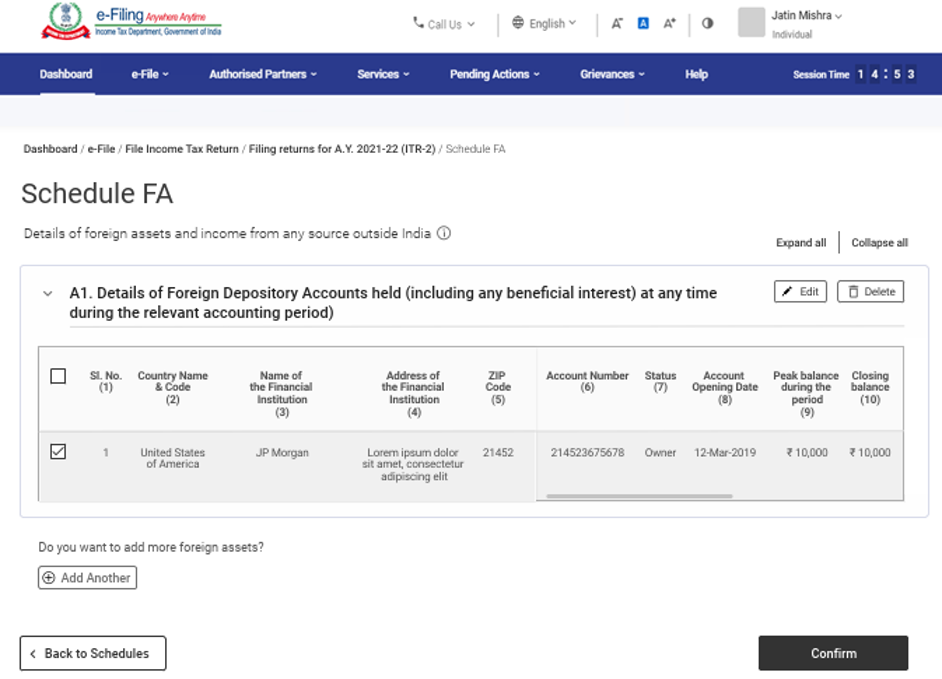

3.20 Schedule FA

3.21 Schedule 5A

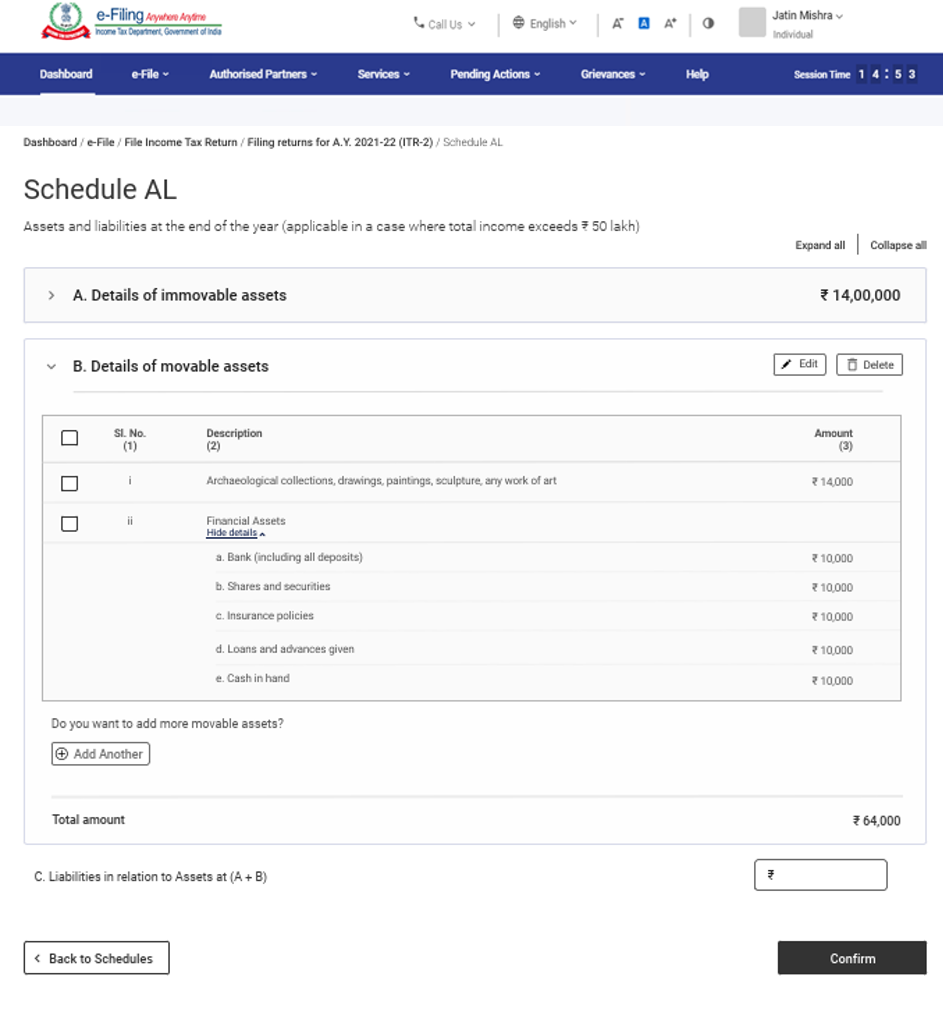

3.22 Schedule AL

3.23 Part B – Total Income (TI)

3.24 Tax Paid

3.25 Part B-TTI

3.1 Part A General

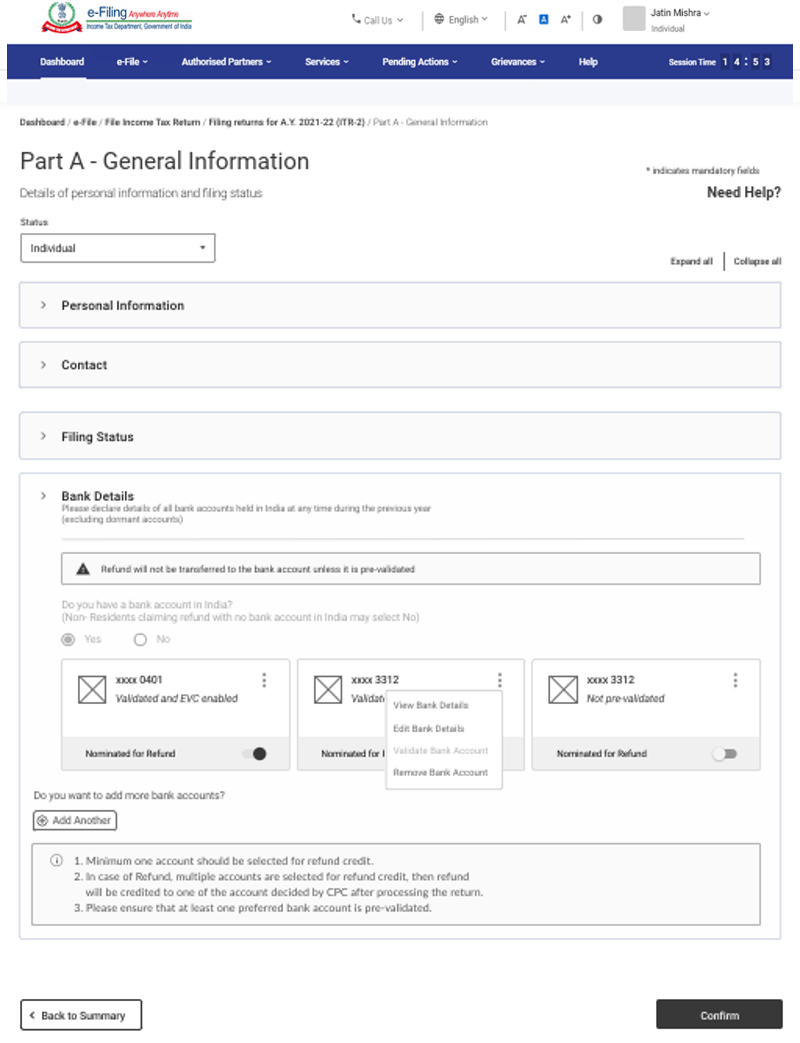

In the Part A General section of the form, you need to verify the pre-filled data from your e-Filing profile. You will not be able to edit some of your personal data directly in the form. However, you can make the necessary changes by going to your e-Filing profile. You can edit your contact details, filing status, residential status and bank details in the form itself.

Personal Information

Contact Details

Filing Status

Bank Details

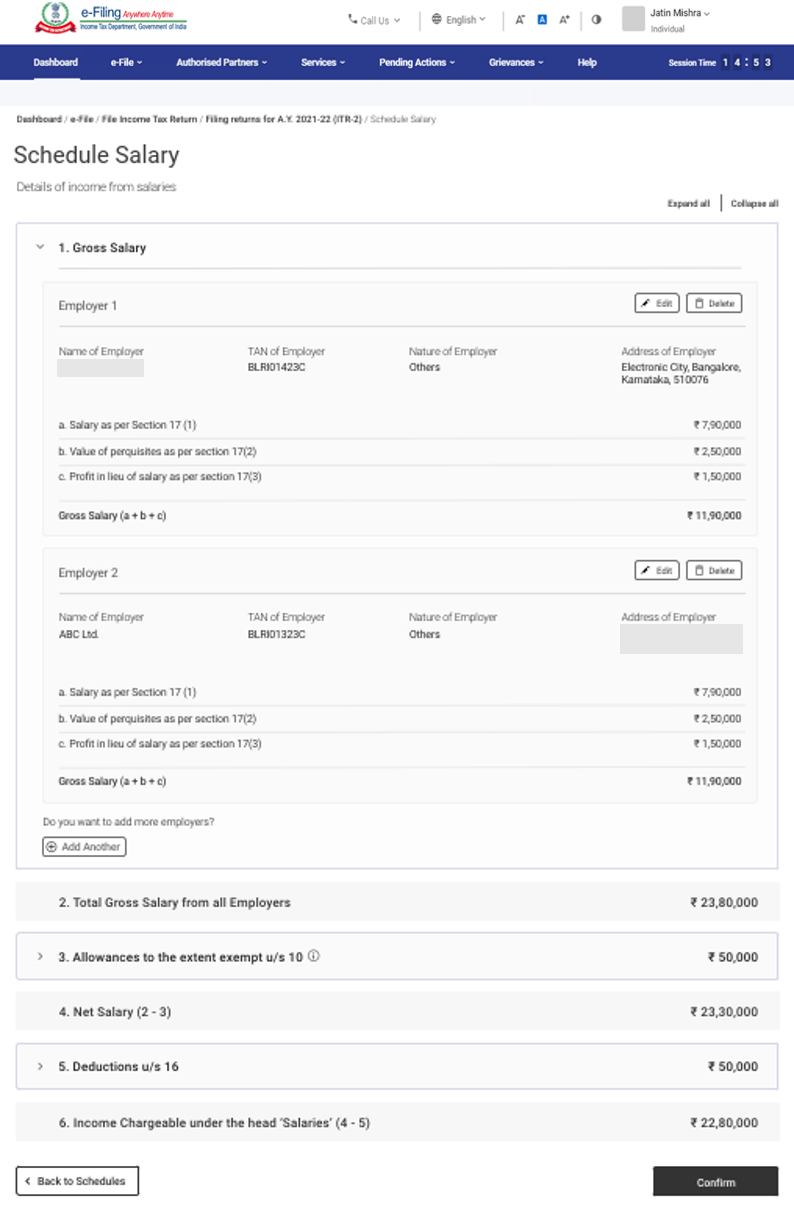

3.2 Schedule Salary

In Schedule Salary, you need to review / enter / edit details of your income from salary / pension, exempt allowances and deductions u/s 16.

3.3 Schedule House Property

In Schedule House Property, you need to review / enter / edit details relating to house property (self-occupied, let out, or deemed let out). The details include co-owner details, tenant details, rent, interest, pass through income etc.

3.4 Schedule CG – Capital Gains

Capital Gains arising from sale / transfer of different types of capital assets have been segregated. In a case where capital gains arises from sale or transfer of more than one capital asset, which are of same type, please make a consolidated computation of capital gains in respect of all such capital assets of same type. But in case of transfer of land / building, it is mandatory to enter the computation towards each land / building. In Schedule Capital Gains, you need to enter details of your Short-Term and Long-Term Capital Gains / Losses for all types of Capital Assets owned.

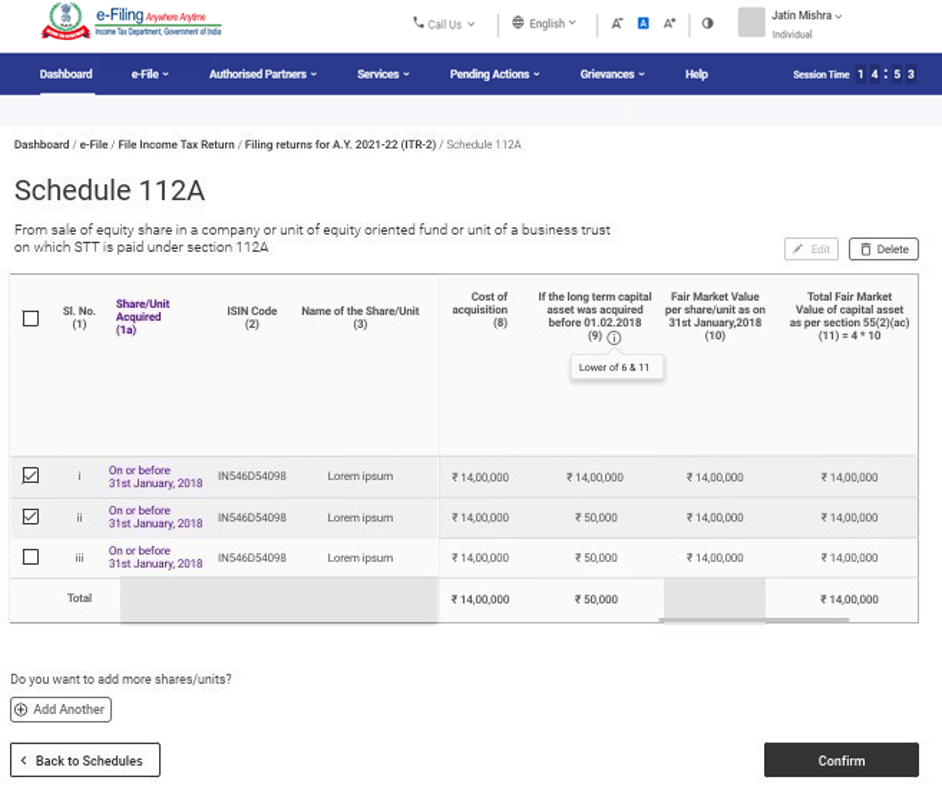

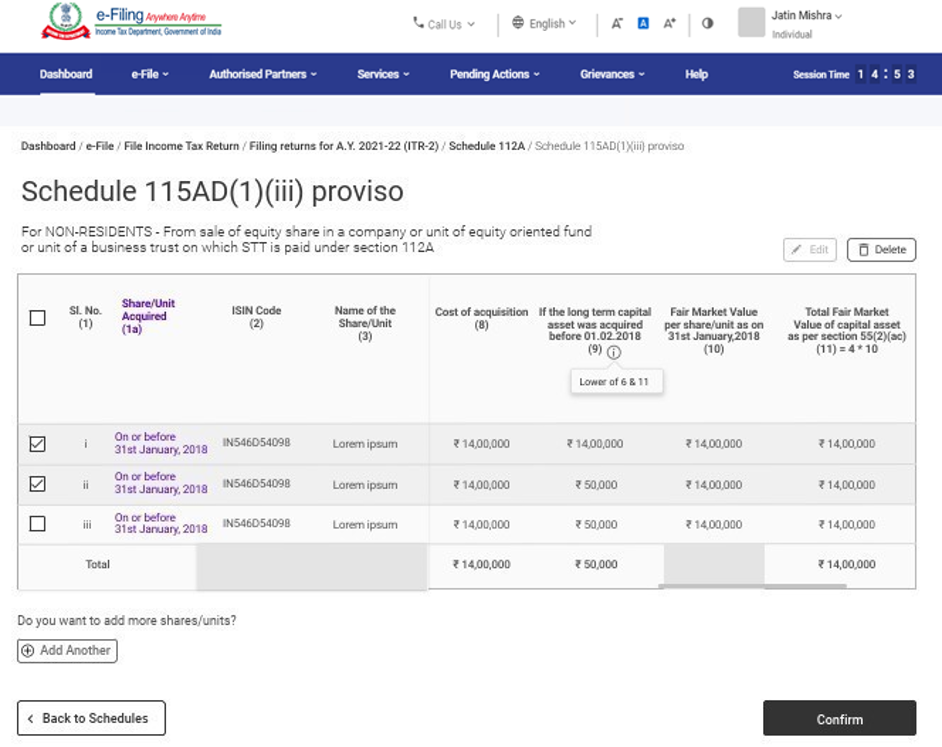

3.5 Schedule 112A and Schedule-115AD(1)(iii) proviso

- In Schedule 112A, you need to review / enter / edit details about sale of equity shares of a company, an equity-oriented fund, or a unit of a business trust on which STT is paid.

- Schedule 115AD (1)(iii) proviso involves entering the same details as for Schedule 112A but is applicable to non-residents.

Note: If Shares are bought on or before 31st Janurary.2018, it is mandatory to enter Scrip-wise details of each transfer under Schedule 112A and Schedule-115AD(1)(iii) proviso.

3.6 Schedule Other Sources

In Schedule Other Sources section, you need to review / enter / edit details of all your income from other sources, including (but not limited to) income charged at special rates, deductions u/s 57 and income involving race horses.

3.7 Schedule Schedule Current Year’s Loss Adjustment (CYLA)

In Schedule Current Year’s Loss Adjustment (CYLA), you will be able to view details of income after set-off of current year losses. The unabsorbed losses allowed to be carried forward out of this are taken to Schedule CFL for carry forward to future years.

3.8 Schedule Schedule Brought Forward Loss Adjustment (BFLA)

In Schedule Brought Forward Loss Adjustment (BFLA), you can view the details of income after set-off of brought forward losses of earlier years.

3.9 Schedule Schedule Carry Forward Losses (CFL)

In Schedule Carry Forward Losses (CFL), you can view the details of losses to be carried forward to future years.

3.10 Schedule VI-A

In the Schedule VI-A, you need to add and verify any deductions you need to claim under Section 80 – Parts B, C, CA, and D (subsections as specified below) of the Income Tax Act.

Note: Please note that the deduction in respect of the investment/ deposit/ payments for the period 1st April 2020 to 31st July 2020 cannot be claimed again, if already claimed in the AY 20-21.

Part A – Deduction in respect of certain payments

Part C, CA and D – Deduction in respect of other income / deductions

3.11 Schedule 80G and Schedule 80GGA

In Schedule 80G and Schedule 80GGA, you need to provide details of details of donations entitled for deduction under Section 80G and Section 80GGA.

3.12 Schedule AMT

In Schedule AMT, you need to confirm the computation of Alternate Minimum Tax payable u/s 115JC.

3.13 Schedule AMTC

In Schedule AMTC, you need to add details of tax credits u/s 115JD.

3.14 Schedule SPI

In Schedule SPI, you need to add the income of specified persons (e.g. spouse, minor child) that is includable or required to be clubbed with your income as per Section 64.

3.15 Schedule SI

In Schedule SI, you will be able to view the income that is chargeable to tax at special rates. The amount under various income types are taken from the amounts provided in the relevant Schedules i.e., Schedule OS, Schedule BFLA.

3.16 Schedule Exempt Income (EI)

In Schedule Exempt Income (EI), you need to provide your details of exempt income i.e., income not to be included in total income or not chargeable to tax. The income types included in this schedule include interest, dividend, agricultural income, any other exempt income, income not chargeable to tax through DTAA and pass through income which is not chargeable to tax.

3.17 Schedule Pass Through Income (PTI)

In Schedule Pass Through Income (PTI), you need to provide details of pass through income received from business trust or investment fund as referred to in section 115UA or 115UB.

3.18 Schedule Foreign Source Income (FSI)

In Schedule Foreign Source Income (FSI), you need to report the details of income, which is accruing or arising from any source outside India. This schedule is available for residents only.

3.19 Schedule TR

In Schedule TR, you need to provide a summary of tax relief which is being claimed in India for taxes paid outside India in respect of each country. This schedule captures a summary of detailed information furnished in Schedule FSI.

3.20 Schedule FA

In Schedule FA, you need to provide details of foreign asset or income from any source outside India. This schedule need not be filled up if you are Not Ordinarily Resident or a Non-Resident.

3.21 Schedule 5A

In Schedule 5A, you need to provide the information necessary for apportionment of income between husband and wife if you are governed by the system of community of property under the Portuguese Civil Code 1860.

3.22 Schedule AL

If your total income exceeds ₹50 lakh, it is mandatory to disclose the details of movable and immovable assets in Schedule AL along with liabilities incurred in relation to such assets. If you are a non-resident or resident but not ordinarily resident, only the details of assets located in India are to be mentioned.

3.23 Part B – Total Income (TI)

In the Part B –Total Income (TI) section, you will be able to view your computation of total income auto-populated from all the schedules you filled in the form.

3.24 Tax Paid

In the Tax Paid section, you need to verify your tax details as paid by you in the previous financial year. Tax details include TDS from Salary / TDS from Income Other than Salary, TCS, Advance Tax and Self-Assessment Tax.

3.25 Part B-TTI

In the Part B-TTI section, you will be able to view the overall computation of total income tax liability on total income.

Note: For more details, refer to the instructions to file ITR issued by CBDT for AY 2021-22.

4. How to Access and Submit ITR-2

You can file and submit your ITR through the following methods:

- Online Mode – through e-Filing portal

- Offline Mode – through Offline Utility

You can refer to the Offline Utility for ITRs user manual to learn more.

Follow the steps below to file and submit the ITR through online mode:

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: On your Dashboard, click e-File > Income Tax Returns > File Income Tax Return.

Step 3: Select Assessment Year as 2021 – 22 and click Continue.

Step 4: Select Mode of Filing as Online and click Proceed.

Note: In case you have already filled the Income Tax Return and it is pending for submission, click Resume Filing. In case you wish to discard the saved return and start preparing the return afresh click Start New Filing.

Step 5: Select Status as applicable to you and click Continue to proceed further.

Step 6: You have two options to select the type of Income Tax Return:

- If you are not sure which ITR to file, you may select Help me decide which ITR Form to file and click Proceed. Once the system helps you determine the correct ITR, you can proceed with filing your ITR.

- If you are sure which ITR to file, select I know which ITR Form I need to file. Select the applicable Income Tax Return from the dropdown and click Proceed with ITR.

Note:

- In case you are not aware which ITR or schedules are applicable to you or income and deductions details, your answers in response to a set of questions will guide in determining the same and help you in correct / error free filing of ITR.

- In case you are aware of the ITR or schedules applicable to you or income and deduction details, you can skip these questions.

- Refer to the Identification and Generation of ITR for AY 21-22 user manual to learn more.

Step 7: Once you have selected the ITR applicable to you, note the list of documents needed and click Let’s Get Started.

Step 8: Select the checkboxes applicable to you and click Continue.

Step 9: Review your pre-filled data and edit it if necessary. Enter the remaining / additional data (if required). Click Confirm at the end of each section.

Step 10: Enter your income and deduction details in the different section. After completing and confirming all the sections of the form, click Proceed.

Step 10a: In case there is a tax liability

You will be shown a summary of your tax computation based on the details provided by you. If there is tax liability payable based on the computation, you get the Pay Now and Pay Later options at the bottom of the page.

Note:

- It is recommended to use the Pay Now option. Carefully note the BSR Code and Challan Serial Number and enter them in the details of payment.

- If you opt to Pay Later, you can make the payment after filing your Income Tax Return, but there is a risk of being considered as an assessee in default, and liability to pay interest on tax payable may arise.

Step 10b: In case there is no tax liability (No Demand / No Refund) or if you are eligible for a Refund

After paying tax, click Preview Return. If there is no tax liability payable, or if there is a refund based on tax computation, you will be taken to the Preview and Submit Your Return page.

Step 11: On the Preview and Submit Your Return page, enter Place, select the declaration checkbox and click Proceed to Validation.

Note: If you have not involved a tax return preparer or TRP in preparing your return, you can leave the textboxes related to TRP blank.

Step 12: Once validated, on your Preview and Submit your Return page, click Proceed to Verification.

Note: If you are shown a list of errors in your return, you need to go back to the form to correct the errors. If there are no errors, you can proceed to e-Verify your return by clicking Proceed to Verification.

Step 13: On the Complete your Verification page, select your preferred option and click Continue.

It is mandatory to verify your return, and e-Verification (recommended option – e-Verify Now) is the easiest way to verify your ITR – it is quick, paperless, and safer than sending a signed physical ITR-V to CPC by post.

Note: In case you select e-Verify Later, you can submit your return, however, you will be required to verify your return within 120 days of filing of your ITR.

Step 14: On the e-Verify page, select the option through which you want to e-Verify the return and click Continue.

Note:

- Refer to How to e-Verify user manual to learn more.

- If you select Verify via ITR-V, you need to send a signed physical copy of your ITR-V to Centralized Processing Center, Income Tax Department, Bengaluru 560500 by normal / speed post within 120 days.

- Please make sure you have pre-validated your bank account so that any refunds due maybe credited to your bank account.

- Refer to My Bank Account user manual to learn more.

Once you e-Verify your return, a success message is displayed along with the Transaction ID and Acknowledgment Number. You will also receive a confirmation message on your mobile number and email ID registered on the e-Filing portal.

Source: www.incometax.gov.in

→

→

0 comments:

Post a Comment