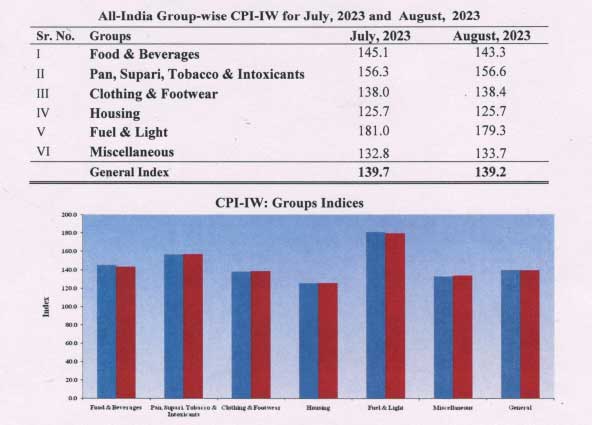

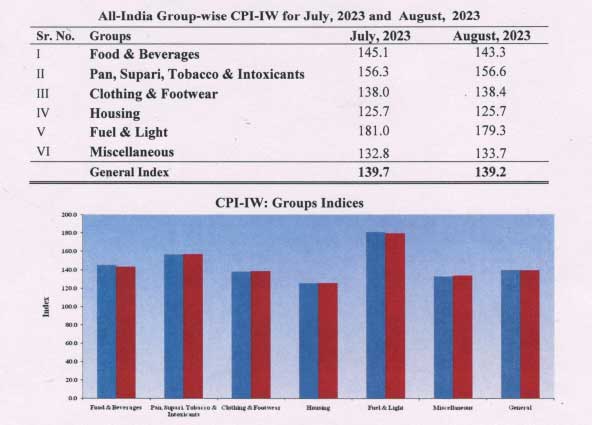

AICPIN Figures for August 2023- Press ReleaseGOVERNMENT OF INDIAMINISTRY OF LABOUR & EMPLOYMENTLABOURBUREAUShram Bureau Bhawan, Block No.2,Institutional Area, Sector 38 (West),Chandigarh – 160036Dated: 29th September, 2023F.No. 5/l/202l-CPlPress ReleaseConsumer Price Index for Industrial Workers (2016=100) – August, 2023The Labour Bureau, an attached office of the M/o Labour & Employment, has been compiling Consumer Price Index for Industrial...

Read More ->>