The Impact of Grievance Redressal By Pension Adalat : Substantial Decrease in the Number of Pensioners Grievances from 2019

There is substantial decrease in the number of pensioners’ grievances due to Grievance Redressal By Pension Adalat

Grievance Redressal By Pension Adalat

The Members of Parliament Shri Sadanand Mhalu Shet Tanavade, Shri Baburam Nishad and Shri Subhash Barala raised a question regarding the impact of Grievance Redressal By Pension Adalat from 2019-2014. The questions and the answer of the Government is given below

Will the PRIME MINISTER be pleased to state:

(a) the increase in Grievance Redressal By Pension Adalat from 2019-2024; and

(b) the impact of ‘pension to senior citizens’ empowering them to live with dignity?

Answer by Minister Of State In The Ministry Of Personnel, Public Grievances And Pensions And Minister Of State In The Prime Minister’s Office (DR. JITENDRA SINGH)

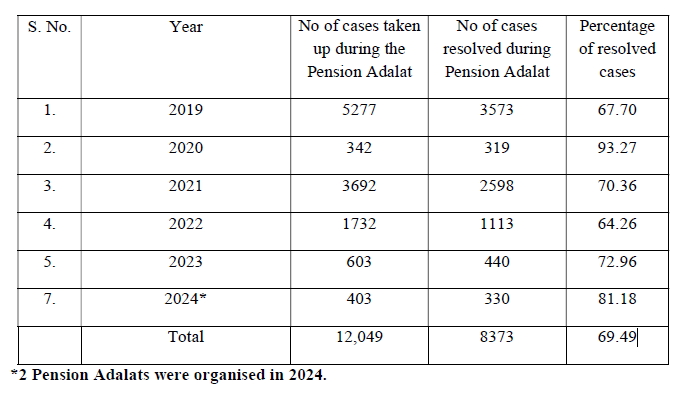

(a) and (b): Pension Adalat is an important administrative reform for improving pensioners’ welfare by timely and effective redressal of long-standing grievances of Central Government Pensioners. There is substantial decrease in the number of pensioners’ grievances due to the Pension Adalats. The status of Pensioners’ grievances redressed in last 8 Pension Adalats since

2019 is as follows:-

The Status of Redressal of Pensioners Grievances

To enable pensioners’ to live with dignity, the pension and family pension is revised by Government with general orders in implementation of recommendations of Central Pay Commission or otherwise. As on date, there have been successive pension revisions from the 3rd to the 7th Central Pay Commissions. The additional pension to old pensioners/family pensioners on completion of 80 years of age or above is payable in the following manner (as per the provisions of Rule 44(6) and 50(3) of CCS(Pension) Rules 2021):

| Age of pensioner/family pensioner | Additional pension/family pension |

| From 80 years to less than 85 years | 20% of basic pension/family pension |

| From 85 years to less than 90 years | 30% of basic pension/family pension |

| From 90 years to less than 95 years | 40% of basic pension/family pension |

| From 95 years to less than 100 years | 50% of basic pension/family pension |

| 100 years or more | 100% of basic pension/family pension |

→

→

0 comments:

Post a Comment